Here's Why You Should Retain Inari Medical (NARI) Stock Now

Inari Medical, Inc. NARI is well poised for growth, backed by a huge market opportunity for products and its commitment to understand the venous system. However, its dependency on adoption of products is a concern.

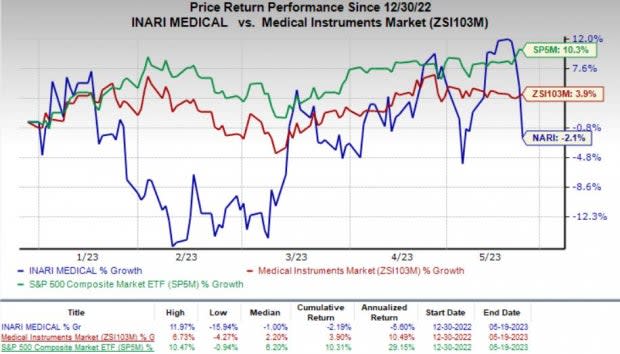

Shares of this Zacks Rank #3 (Hold) company have lost 2.1% against the industry’s 3.9% growth so far this year. The S&P 500 Index has risen 10.3% in the same time frame.

NARI, with a market capitalization of $3.55 billion, is a commercial-stage medical device company. It seeks to develop products for treating and changing the lives of patients suffering from venous diseases.

The company’s earnings yield of (0.5%) compares favorably with the industry’s (7.2%). Its earnings beat estimates in each of the trailing four quarters, the average surprise being 39.03%.

Image Source: Zacks Investment Research

What’s Driving NARI’s Performance?

Inari Medical is spearheading the creation and commercialization of devices that are purposefully built, keeping in mind the specific characteristics of the venous system, its diseases and unique clot morphology.

The company’s in-depth knowledge of its target market and commitment to understand the venous system have allowed it to figure out the unmet needs of patients as well as physicians. This, in turn, has enabled NARI to quickly innovate and improve its products while updating its clinical and educational programs.

In January, Inari Medical enrolled the first patient in its prospective randomized controlled trial — DEFIANCE. The idea was to compare the clinical outcomes of ClotTriever System to anticoagulation, only in patients with iliofemoral deep vein thrombosis (DVT).

A successful completion will support the favorable profile of Inari Medical’s key product, ClotTriever, in treating DVT patients.

In October 2022, NARI announced positive in-hospital and 30-day outcomes data from the fully-enrolled CLOUT deep vein thrombosis registry. The company also reported positive results from a propensity-matched comparison of patients treated in the CLOUT registry to those treated with pharmacomechanical thrombolysis in an NIH-sponsored randomized controlled trial, ATTRACT.

The analysis showed that patients had complete thrombus clearance following treatment with the ClotTriever system, at nearly twice the rate of patients in the intervention arm of ATTRACT.

ClotTriever also resulted in significantly fewer patients with post-thrombotic syndrome (PTS), with an absolute reduction of 13% at 30 days. The trial data demonstrated that the system removed more clots than other interventional options, and resulted in better patient outcomes and lower PTS rates.

These results will likely lead to higher adoption of the treatment among physicians and patients.

Last year, NARI announced favorable outcomes of the fully enrolled 800-patient FLASH registry in pulmonary embolism (PE). The primary endpoint of the registry was successfully met by FlowTriever for the treatment of PE. The company is also conducting a PEERLESS randomized controlled trial in patients suffering from the disease.

Inari Medical stated that a significant percentage of DVT and PE patients are treated using conservative medical management that involves anticoagulants alone, which do not break down or remove an existing clot. It believes that there is a huge untapped demand for safe and effective treatment and removal of existing clots in patients with these diseases.

NARI reported total revenues of $116.2 million for the first quarter, indicating a 34% improvement year over year.It expanded its territories to more than 275 in 2022.

Inari Medical expects total revenues in the range of $478-$488 million for 2023, indicating growth of approximately 24.6-27.2% from the previous year’s reported actual.

What’s Weighing on the Stock?

Most of NARI’s product sales and revenues come from a limited number of hospitals. The company’s growth and profitability mainly depend on its ability to boost physician and patient awareness of its products. These also depend on how keen physicians and hospitals are to adopt its products and perform catheter-based thrombectomy procedures on patients suffering from venous thromboembolism.

Inari Medical’s inability to validate the benefits of its products and catheter-based thrombectomy procedures will result in limited adoption of the same. Moreover, it might not happen as quickly as expected. These factors, in unison, might negatively impact NARI’s business and financial condition.

Inari Medical, Inc. Price

Inari Medical, Inc. price | Inari Medical, Inc. Quote

Estimates Trend

The Zacks Consensus Estimate for revenues is pegged at $482.2 million for 2023, indicating a 25.6% increase from the previous year’s reported number. The bottom-line estimate for the company is pinned at a loss of 29 cents, implying a 47.3% improvement from that recorded a year ago.

Stocks to Consider

Some better-ranked stocks from the broader medical space are Merit Medical Systems MMSI, West Pharmaceutical Services WST and Perrigo PRGO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merit Medical Systems has an estimated long-term growth rate of 11%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 20.22%.

So far this year, MMSI’s shares have gained 18.9% compared with the industry’s 8.7% growth.

West Pharmaceutical Services has an estimated long-term growth rate of 6.3%. Its earnings surpassed estimates in three of the trailing four quarters and missed the same once, the average surprise being 13.61%.

So far this year, WST’s shares have gained 49.1% compared with the industry’s 8.7% growth.

Perrigo’s earnings are expected to improve 24.2% in 2023. The strong momentum is likely to continue in 2024 as well. PRGO’s earnings surpassed estimates in two of the trailing four quarters and missed twice, the average negative surprise being 0.79%.

The company has lost 1.9% so far this year against the industry’s 4.8% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report