Here's Why You Should Retain Lithia (LAD) Stock Right Now

Lithia Motors, Inc. LAD is benefiting from a diversified product mix and strategic buyouts that are helping the auto retailer increase its market share and boost its portfolio amid rising debt levels & expenses.

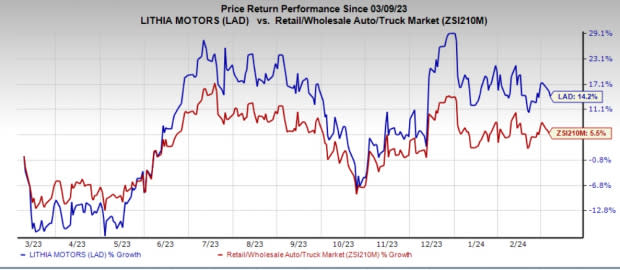

Shares of this leading automotive retailers of new and used vehicles have gained 14.2% over a year compared with the industry’s growth of 5.5%.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

Diversified Product Mix & Acquisitions to Aid Lithia

Lithia’s diversified product mix and multiple streams of income reduce its risk profile and position it for long-term top and bottom-line growth. The company believes that it is well-placed to generate mid-$40 billion in revenues by 2025, thanks to market expansion efforts and omnichannel presence. Additionally, it aims to attain a ratio of 2:1 for EPS to every $1 billion in revenues generated by 2025. These targets spark optimism.

Enhanced digital solutions, including the Driveway e-commerce program, are helping Lithia further boost profitability and market presence. It is the company’s e-commerce home solution, which enables customers to purchase or sell vehicles online and schedule at-home services. Growth on the Driveway platform would serve as a key to longer-term market share gains and earnings accretion.

Lithia’s strategic buyouts are helping the auto retailer increase its market share and boost its portfolio. Its spree of acquisitions brought LAD's total expected annualized revenues to more than $3.5 billion in 2022. The company acquired $3.8 billion in annualized revenues in 2023. In February 2024, it acquired the U.K. car dealership group, Pendragon, solidifying its expansion into Britain and Carousel Motor Group, to expand its footprint in Minneapolis-St. Paul. The Pendragon & Carousel acquisition is expected to add around $4.5 billion and $900 million, respectively, to Lithia’s annualized revenues.

Robust cash flows and investor-friendly moves of the firm are driving shareholders’ confidence. Lithia repurchased 0.21 million shares during 2023. The company's annualized cash flow growth rate has been 32% over the past three to five years compared with the industry average of 16.99%. It has a five-year annualized dividend growth rate of 13.09%.

Rising Debt Levels & Expenses Ail

Rising debt levels play spoilsport and may restrict Lithia’s financial flexibility to tap growth opportunities. In the last reported quarter, the company’s adjusted SG&A as a percentage of gross profit was 65.2%, up from 62.8% reported in the previous year’s quarter. Rising SG&A as a percent of gross profit remains a concern. Also, LAD’s financing operations segment incurred an operating loss of $2.1 million in the last reported quarter. The company doesn’t expect to breakeven in this segment till the latter half of 2024.

Stocks to Consider

Some better-ranked players in the auto space are Modine Manufacturing Company MOD, General Motors Company GM and Allison Transmission Holdings, Inc. ALSN, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings per share (EPS) suggests year-over-year growth of 4% and 67.2%, respectively. The EPS estimates for 2024 have improved 22 cents in the past 60 days. The EPS estimates for 2025 have improved by a penny in the past seven days.

The Zacks Consensus Estimate for GM’s 2024 sales and earnings suggests year-over-year growth of 1.8% and 17.2%, respectively. The EPS estimates for 2024 and 2025 have improved 17 cents and 32 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for ALSN’s 2024 sales and earnings suggests year-over-year growth of 2.1% and 3.2%, respectively. The EPS estimates for 2024 and 2025 have improved 67 cents and 71 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report