Here's Why You Should Retain McKesson (MCK) Stock for Now

McKessonCorporation MCK is well-poised for growth, backed by strategic collaborations and strength in the Distribution Solutions segment. However, the company’s opioid-related litigation expenses are a potential threat.

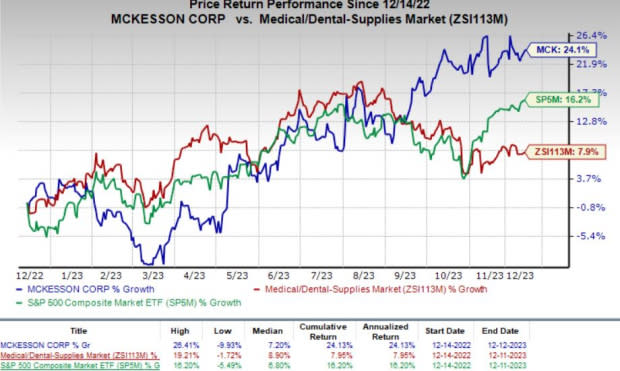

Shares of this currently Zacks Rank #3 (Hold) company have risen 24.1% year to date compared with the industry’s 7.9% growth. The S&P 500 Index has increased 16.2% in the same time frame.

McKesson is a healthcare services and information technology company with a market capitalization of $61.47 billion. Its earnings are anticipated to improve 10.5% over the next five years.

Image Source: Zacks Investment Research

The company’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 8.87%. Its earnings yield of 5.9% compares favorably with the industry’s 4.9%.

Key Growth Drivers

Strength in Biologics: Investors are optimistic about McKesson’s robust Biologics business. Independent specialty pharmacy, Biologics by McKesson, has been making impressive progress lately. The pharmacy was chosen by AstraZeneca and SpringWorks Therapeutics as the distribution partner for their respective drugs, TRUQAP (capivasertib) and OGSIVEO (nirogacestat), earlier this month.

Last month, the pharmacy was selected by Takeda as a specialty pharmacy provider of FRUZAQLA (fruquintinib). In September, it was chosen by GSK as a specialty pharmacy provider of OJJAARA (momelotinib). In August, Biologics was selected by Daiichi Sankyo, Inc. as a specialty pharmacy provider of VANFLYTA (quizartinib).

Strength in Distribution Market: McKesson is a major player in the pharmaceutical and medical supplies distribution market that raises investors’ optimism. The Distribution Solutions segment caters to a wide range of customers and businesses. It also stands to benefit from increased generic utilization and inflation in generics, driven by several patent expirations in the next few years and an aging population.

Per management, the uptick in the company’s U.S. Pharmaceutical and Medical-Surgical Solutions segment’s adjusted operating profit was driven by growth in the distribution of specialty products to providers and health systems, higher contribution from generics and growth of GLP-1 medication in the first quarter of fiscal 2024.

Strong Q2 Results: McKesson’s robust second-quarter fiscal 2024 results buoy optimism. The company recorded strong top and bottom-line performances and strength in its U.S. Pharmaceutical, Medical-Surgical Solutions and Prescription Technology Solutions segments.

Downsides

Weak Trends: McKesson distributes generic pharmaceuticals, which are subject to price fluctuations. The Distribution Solutions segment continues to experience a weaker generic pharmaceutical pricing trend. Continued volatility, unfavorable pricing trends, reimbursement of generic drugs and significant fluctuations in the nature, and frequency and magnitude of generic pharmaceutical launches could have an adverse impact on McKesson.

Stiff Competition: Distribution Solutions faces stiff competition both in terms of price and service from various full-line, short-line and specialty wholesalers, service merchandisers, self-warehousing chains, manufacturers engaged in direct distribution, third-party logistics companies and large-payer organizations. Moreover, MCK depends on fewer suppliers for its products. As a result, it is not in a position to negotiate pricing.

Estimates Trend

The Zacks Consensus Estimate for fiscal 2024 revenues is pegged at $304.19 billion, indicating a 9.9% increase from the previous year’s level. The consensus mark for adjusted earnings per share is pinned at $27.23, implying a 5% year-over-year improvement.

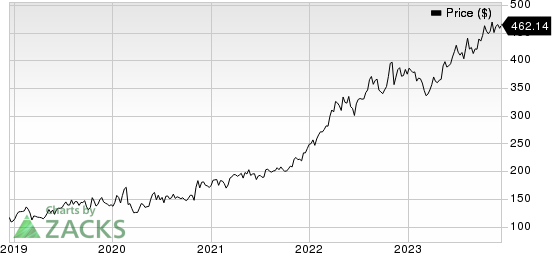

McKesson Corporation Price

McKesson Corporation price | McKesson Corporation Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are DexCom DXCM, HealthEquity, Inc. HQY and Biodesix BDSX.

DexCom, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 33.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DXCM’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 36.43%. The company’s shares have risen 4.2% year to date compared with the industry’s 3.8% growth.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 26.8%. HQY’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 16.5%.

The company’s shares have rallied 15% year to date against the industry’s 9.9% decline.

Biodesix, carrying a Zacks Rank #2 at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.76%.

The stock has fallen 30.9% year to date compared with the industry’s 9.9% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report