Here's Why You Should Retain Myriad Genetics (MYGN) Stock Now

Myriad Genetics MYGN is well poised for growth in coming quarters, backed by a strong improvement in testing volume across all its businesses. The recent collaboration with QIAGEN looks impressive. Yet, foreign exchange headwinds and stiff competition are a concern.

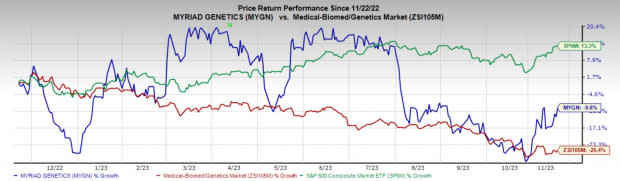

In the past year, this Zacks Rank #3 (Hold) stock has declined 9.6% compared with 25.4% fall of the industry and a 13.3% rise of the S&P 500 composite.

The renowned genetic testing and precision medicine company has a market capitalization of $1.62 billion. Myriad Genetics surpassed estimates in two of the trailing four quarters and missed the same in the other two, delivering an average negative earnings surprise of 24.24%.

Let’s delve deeper.

Tailwinds

Huge Potential in Oncology Testing: As a leader in genetic testing and precision medicine, Myriad Genetics provides insights that help people take control of their health and enable healthcare providers to better detect, treat and prevent disease. The company believes that the expansion of companion diagnostics, market expansion through new clinical guidelines and providing new offerings are key opportunities to boost its Oncology business.

In the third quarter of 2023, hereditary cancer testing volumes from the oncology business rose 15% year over year, well above the estimated industry growth, reflecting enduring franchise and improving its brand reputation. Prolaris — the prostate cancer test — continued its momentum, with third-quarter revenues up 18% year over year.

Product Launches: Myriad Genetics launched a slew of products in recent months.

In August 2023, Myriad Genetics announced enhancements to the GeneSight Psychotropic test — a pharmacogenomic test for mental health medications. The GeneSight report will now include information on how a patient's smoking status may impact their body's metabolism of certain medications.

Image Source: Zacks Investment Research

The same month, Myriad Genetics announced the integration of Absolute Risk Reduction (ARR) into the Prolaris Prostate Cancer Prognostic Test to help patients and providers make personalized treatment decisions regarding hormone therapy.

Strategic Partnerships to Drive Growth: In September 2023, Myriad Genetics entered into a research collaboration with Memorial Sloan Kettering Cancer Center (MSK). The partnership will study the use of minimal residual disease (MRD) testing in breast cancer by using Myriad’s MRD testing platform. This tumor-informed high-definition assay uses whole-genome sequencing to achieve high sensitivity and specificity for circulating tumor DNA (ctDNA).

During the third quarter, Myriad Genetics collaborated with QIAGEN to develop kit-based companion diagnostic tests, combining its strengths in assay development, clinical testing and regulatory approvals. The opportunity to better serve pharma partners, but we hope that this collaboration sets the stage for advanced analysis and accessibility of MRD and HRD assays to improve cancer treatment decision-making potentially.

Downsides

Foreign Exchange Headwinds: Myriad Genetics receives a considerable portion of its revenues and pays an amount of its expenses in foreign currencies. As a result, the company remains at risk of exchange rate fluctuations between foreign currencies and the U.S. dollar.

Increasing Competition: With the entry of new players, imminent price competition is a concern. Per management, Myriad Genetics is currently facing competition in its key BRACAnalysis market. The company expects competition to intensify in its current fields with recently observed advancements in technology.

Estimate Trend

The Zacks Consensus Estimate for MYGN’s 2023 loss per share has moved up from 31 cents to 30 cents in the past 30 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $750. 7 million. The projection suggests a 10.7% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom carry a Zacks Rank #2 (Buy), Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have plunged 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report