Here's Why You Should Retain PacBio (PACB) Stock for Now

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, is well-poised for growth in the coming quarters, courtesy of its slew of strategic deals over the past few months. The optimism led by a solid second-quarter 2023 performance and its product development activities are expected to contribute further. However, stiff competition and forex volatility persist.

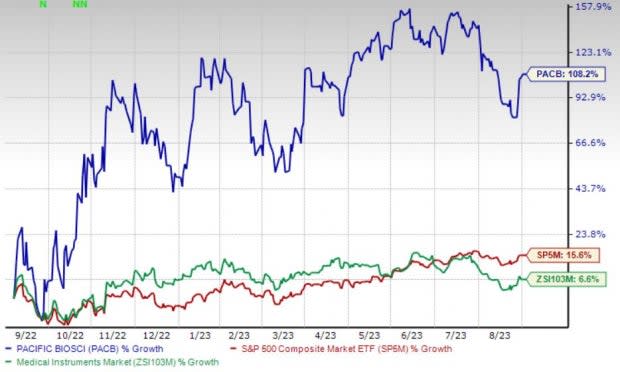

Over the past year, this Zacks Rank #3 (Hold) stock has gained 108.2% compared with 6.6% growth of the industry and a 15.6% rise of the S&P 500.

The renowned global provider of sequencing systems has a market capitalization of $2.86 billion. The company projects 14.5% growth for 2023 and expects to maintain a strong performance. PacBio’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and broke even once, the average surprise being 9.5%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Deals: We are optimistic about PacBio’s robust growth opportunities via its inking of a slew of strategic deals over the past few months. In August, the company and GeneDx announced a research collaboration with the University of Washington to study the capabilities of HiFi long-read whole genome sequencing to increase diagnostic rates in pediatric patients with genetic conditions.

Also, in August, PacBio entered into an agreement to acquire Apton Biosystems, Inc.

Product Development Activities: We are optimistic about PacBio's solid potential in the RNA-sequencing market, which has been fortifying the company’s footprint worldwide. In August, PacBio announced the commencement of customer shipments of Onso short-read sequencing instruments.

In April, PacBio announced the availability of its new high-throughput Nanobind DNA Extraction kits, another key product from its Circulomics acquisition.

Strong Q2 Results: PacBio saw a robust increase in its overall top line, including strong Product and Instrument revenues, in the second quarter of 2023. Solid geographical performances were also recorded. Continued strong prospects in the Revio and Onso systems, with customers placing orders for these, were also seen.

Downsides

Forex Volatility: The majority of PacBio’s revenues, expenses and capital purchasing activities are transacted in U.S. dollars. Further, a portion of its operations consists of development and sales activities outside the United States, and therefore, the company has foreign exchange exposures relating to non-U.S. dollars. A strengthening of the U.S. dollar exchange rate against all currencies in which PacBio operates, after considering offsetting positions, would have resulted in a significant decrease in the carrying amounts of its net assets.

Stiff Competition: PacBio operates in a highly competitive market where its competitors offer nucleic acid sequencing equipment or consumables. Many of these companies currently have greater resources and may be able to respond more quickly and effectively than PacBio to new or changing opportunities, technologies, standards or customer requirements.

Estimate Trend

PacBio has been witnessing a positive estimate revision trend for 2023. Over the past 90 days, the Zacks Consensus Estimate for its adjusted loss per share has narrowed from $1.29 to $1.18.

The Zacks Consensus Estimate for the company’s third-quarter 2023 revenues is pegged at $48.1 million, suggesting a 48.9% uptick from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 16.7% against the industry’s 2.3% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 9.1%.

HealthEquity has gained 4.7% against the industry’s 11.1% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 42.9% compared with the industry’s 6.6% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report