Here's Why You Should Retain QIAGEN (QGEN) Stock for Now

QIAGEN N.V. QGEN is well-poised for growth in the coming quarters, backed by the rapid growth in the molecular diagnostics business. The company’s Digital Insights business has been driving sales in recent times. NGS-based forensics and human identification applications through acquiring Verogen look encouraging. Stiff competition and forex woes are a concern.

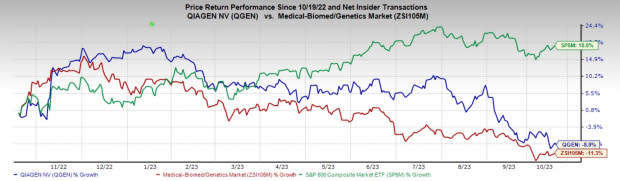

In the past year, this Zacks Rank #3 (Hold) stock has declined 8.9% compared with a 11.3% decline of the industry. The S&P 500 composite has witnessed a 18.8% rise in the said time frame.

The renowned global provider of sample and assay technologies has a market capitalization of $8.87 billion. QIAGEN has an earnings yield of 5.29% compared with the industry (44.59%). QGEN’s earnings surpassed estimates in all the trailing four quarters, delivering an average surprise of 10.27%.

Let’s delve deeper.

Upsides

Huge Potential in Molecular Diagnostics: QIAGEN’s Molecular Diagnostics customers accounted for $1.1 billion in sales in 2022. Our estimate suggests a CAGR of 6.8% between 2023 and 2025.

In terms of the latest development, QIAGEN’s market-leading QuantiFERON latent TB test delivered an outstanding second quarter of 2023, generating 27% CER growth and crossing a significant milestone with quarterly sales rising above $100 million for the first time. The company continues to see healthy conversion trends from the tuberculin skin test. Our estimate suggests that the QuantiFERON latent TB test to register a CAGR of 6.4% between 2023-2025.

Strategic Collaborations to Drive Growth: QIAGEN’s long-term business strategy involves entering into strategic alliances and marketing and distribution arrangements with academic, corporate and other partners relating to the development, commercialization, marketing and distribution of certain of their existing and potential products.

In July 2023, QIAGEN expanded its digital PCR (dPCR) offering to develop cell and gene therapies in the biopharma industry. The company has partnered with Niba Labs to offer customized digital PCR assay design services to biopharma customers and also launched the new CGT Viral Vector Lysis Kit that enables a standardized workflow from cell lysates to absolute and precise quantification of viral titers for multiple serotypes.

Solid NGS Platform Prospects: QIAGEN’s NGS portfolio has witnessed double-digit revenue growth over the past few quarters.

Image Source: Zacks Investment Research

QIAGEN is also considered a top provider of consumable and bioinformatics solutions for use with any next-generation sequencer. In those businesses, especially QIAGEN Digital Insight for bioinformatics, QGEN has taken significant market share and delivered strong growth in recent years.

Downsides

Competitive Headwinds: Considering QIAGEN’s huge gamut of services, the company is also susceptible to competitive headwinds. The company faces increasing competition from firms that provide competitive pre-analytical solutions and other products used by QIAGEN’s customers. The markets for some of the company’s products are very competitive and price-sensitive. Other product suppliers may have significant advantages in terms of financial, operational, sales and marketing resources and experience in research and development.

Foreign Exchange Uncertainties: Recording more than 50% of its revenues from the international market, QIAGEN is highly exposed to the risk of foreign currency movement. The situation may worsen with the strengthening of the domestic currency against high-focus nations. Any unanticipated currency headwinds in high-focus markets may drag the top and the bottom line further.

Estimate Trend

In the past 30 days, the Zacks Consensus Estimate for QIAGEN’s 2023 earnings per share has remained constant at $2.07.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $1.97 billion. This suggests a decrease of 8% from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. (DVA ), Cardinal Health CAH and Align Technology ALGN, each carrying a Zacks Rank #2.

DaVita has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 25.5% against the industry’s 8.9% decline in the past year.

Cardinal Health stock has risen 21.3% in the past year. Earnings estimates for the company have increased from $6.65 to $6.66 for 2023 and have remained constant at $7.56 for 2024 in the past 30 days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.03%. In the last reported quarter, it posted an earnings surprise of 4.73%.

Estimates for Align Technology’s 2023 earnings have increased from $8.77 to $8.78 per share in the past 30 days. Shares of the company have increased 27% in the past year compared with the industry’s rise of 14.3%.

ALGN’s earnings beat estimates in three of the trailing four quarters and missed in one. In the last reported quarter, it posted an earnings surprise of 9.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report