Here's Why You Should Retain Roper (ROP) in Your Portfolio

Roper Technologies, Inc. ROP has been witnessing solid momentum across each of its segments. The company’s Application Software segment is benefiting from strength across its Deltek, Vertafore, Strata, Frontline and Aderant businesses. Strong momentum in iPipeline, DAT and Loadlink businesses and excellent bookings in the Foundry business have been supporting the Network Software segment’s growth. Strength across the Neptune and Verathon businesses augurs well for the Technology Enabled Products segment.

Driven by strength across its businesses, Roper expects total revenues to increase 11-12% year over year in 2024. Organic revenues are estimated to increase 5-6% in the year.

Roper intends to strengthen and expand its businesses through buyouts. The company’s acquisition of Syntellis Performance Solutions (in August 2023) strengthened its Strata Decision Technology business. In October 2022, it acquired Frontline Education for $3.7 billion. The acquisition builds on Roper’s Horizon software business, expanding its presence in the K-12 education market. Acquisitions boosted sales by 4% in the fourth quarter of 2023.

ROP is focused on rewarding shareholders through dividend payouts. In 2023, it rewarded its shareholders with a dividend payment of $290.2 million, up 10.6% year over year. In November 2023, the company also hiked its dividend by 10%.

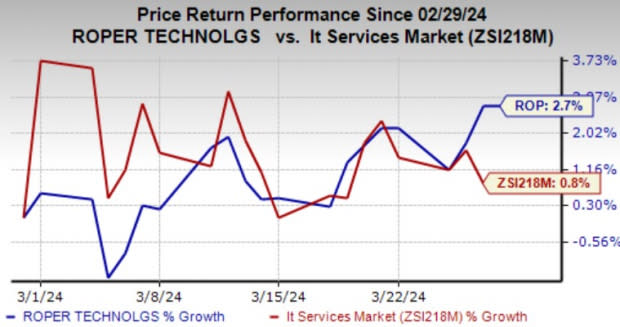

Image Source: Zacks Investment Research

In the past month, this Zacks Rank #3 (Hold) company's shares have moved up 2.7% compared with the industry’s 0.8% growth.

However, escalating costs and expenses have been a concern for ROP over time. In 2023, the cost of sales climbed 15.5% year over year while selling, general and administrative expenses grew 15%. Escalating costs, if not controlled, may impede the company’s bottom line.

High debt levels have also been major concerns for Roper as it raises financial obligations and might drain its profitability. ROP exited 2023 with a long-term debt (net of current portion) of $5.8 billion. Its current portion of long-term debt (net) totaled almost $500 million, higher than its cash equivalents of $214.3 million.

Key Picks

We have highlighted three better-ranked stocks, namely Vertiv Holdings Co VRT, CyberArk Software Ltd. CYBR and Dynatrace, Inc. DT. While Vertiv Holdings sports a Zacks #1 Rank (Strong Buy), CyberArk Software and Dynatrace carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Vertiv Holdings delivered a trailing four-quarter average earnings surprise of 30.4%. In the past 60 days, the Zacks Consensus Estimate for VRT’s 2024 earnings has increased 5.9%.

CyberArk Software delivered a trailing four-quarter average earnings surprise of 76.3%. In the past 60 days, the Zacks Consensus Estimate for CYBR’s 2024 earnings has increased 6.1%.

Dynatrace delivered a trailing four-quarter average earnings surprise of 23.2%. In the past 60 days, the Zacks Consensus Estimate for DT’s 2024 earnings has increased 5.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

Dynatrace, Inc. (DT) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report