Here's Why You Should Retain Tandem Diabetes (TNDM) Now

Tandem Diabetes Care, Inc. TNDM is well-poised for growth in the coming quarters due to its series of innovative product offerings, which continue to generate remarkable enthusiasm. The company’s expansion efforts in the booming diabetes market are highly encouraging. Strong solvency is an added upside.

However, Tandem Diabetes heavily relies on the market acceptance of insulin pumps and related products. The company is also grappling with macroeconomic challenges, which adds to the worry.

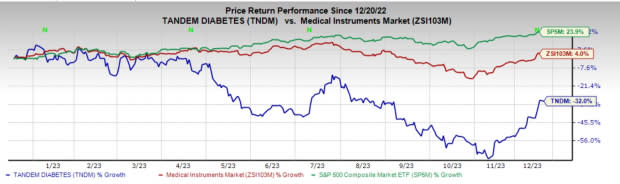

In the past year, this Zacks Rank #3 (Hold) stock has declined 32% compared to the 4% growth of the industry and a 23.9% rise of the S&P 500 composite.

The renowned medical device company has a market capitalization of $1.87 billion. Tandem Diabetes projects an estimated earnings growth rate of 25.7% for 2024 compared with the 21.9% of the industry. In the trailing four quarters, TNDM delivered an average earnings surprise of 18.3%.

Let’s delve deeper.

Tailwinds

Expanding Diabetes Market: Tandem Diabetes' strategic focus in the near and long term is to meaningfully expand the adoption of the insulin pump by people with type 1 diabetes across all its markets and produce more evolved products and services to attract people living with type 2 diabetes who use insulin intensive therapy.

TNDM sees a great opportunity in the Type 1 market, wherein more than one million people in the United States are currently devoid of the benefits of insulin pump therapy and an even larger population in internationally served markets. Moreover, the company’s research indicates more than two million people with type 2 diabetes in the United States are already insulin-dependent and do not use a pump.

Image Source: Zacks Investment Research

Advancements in Product Innovation: Tandem Diabetes is currently undergoing a transitional time as it prepares for the next phase of growth through its innovative portfolio. Recently, it marked the launch of Tandem Source — a diabetes management platform for insulin pump users and healthcare providers. The company also introduced the Dexcom G7 Continuous Glucose Monitoring integrated t:slim X2 insulin pump software in the United States.

The company’s new FDA-approved technology, Tandem Mobi, is leading the way in creating a whole new category of devices for insulin therapy. Moreover, the t:slim X2 with Control-IQ technology continues to stand out as the number-one rated automated insulin delivery system, as evidenced by third-party research and the company’s internal customer satisfaction surveys.

Strong Solvency: On the liquidity front, Tandem Diabetes looks well-placed. The company exited the third quarter of 2023 with cash and cash equivalents and short-term investments of $498.2 million, while it did not report any short-term payable debt. The total debt of $285 million at the third quarter-end was also much less than the corresponding cash balance.

Headwinds

Heavy Dependence on Insulin Pumps: Tandem Diabetes generates a substantial portion of revenues from the sale of insulin pumps. Hence, any factors that negatively impact the sale of these products or cause sales growth at a slower pace could adversely affect the company’s business, financial condition and operating results.

Macroeconomic Headwinds Persist: Tandem Diabetes continues to navigate global macroeconomic challenges, such as recessionary concerns, changes in discretionary spending and increased interest rates, which have impacted its customers’ purchasing decisions and the buying patterns of distributors. The resulting effects of these macroeconomic factors, along with high inflation, have led to the disruption of the company’s relationship with suppliers, third-party manufacturers, healthcare providers, distributors and overall customers.

Estimate Trend

The Zacks Consensus Estimate for Tandem Diabetes’ 2023 loss per share has remained constant at $1.83 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $761.4 million. This suggests a 4.9% fall from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM.

Haemonetics has an estimated earnings growth rate of 27.1% for fiscal 2024 compared with the industry’s 17.2%. HAE’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 19.39%. Its shares have rallied 12.6% against the industry’s 1.3% fall in the past year.

HAE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Insulet, sporting a Zacks Rank #1 at present, has a long-term estimated earnings growth rate of 41.5% compared with the industry’s 12.2%. Shares of the company have decreased 29.8% compared with the industry’s 1.3% decline over the past year.

PODD’s earnings surpassed estimates in all of the trailing four quarters, the average surprise being 126.9%. In the last reported quarter, it delivered an average earnings surprise of 58.3%.

DexCom, carrying a Zacks Rank #2 at present, has an estimated long-term earnings growth rate of 33.6% compared with the industry’s 14.3%. Shares of DXCM have increased 9% compared with the industry’s 3.9% decline over the past year.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Tandem Diabetes Care, Inc. (TNDM) : Free Stock Analysis Report