Here's Why You Should Retain Teleflex (TFX) Stock for Now

Teleflex TFX is well-poised to grow in the coming quarters, backed by the strength of its Vascular business. The company’s Interventional segment continues to outperform in some of its key product portfolios, including balloon pumps. Further, a favorable solvent position also buoys optimism. However, mounting expenses and a competitive space remain concerning for the company.

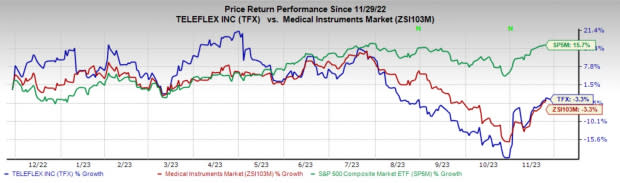

In the past year, this Zacks Rank #3 (Hold) stock has decreased 3.3% compared with the 3.3% fall of the industry and the 15.7% rise of the S&P 500 composite.

The global provider of med-tech products has a market capitalization of $10.34 billion. The company has an earnings yield of 6.06% against the industry’s -7.83%. Teleflex surpassed estimates in each of the trailing four quarters, delivering an average earnings surprise of 5.98%.

Let’s delve deeper.

Tailwinds

Vascular Business Grows: Following the $976-million acquisition of Vascular Solutions, there has been accelerated growth within Teleflex’s vascular product portfolio. Despite the third quarter facing a negative impact of the previously announced Endurance catheter recall, the segment managed to grow 0.3% in revenues. Over the long term, TFX remains positioned for dependable growth with category leadership in Central Venous Catheters and midlines, anticipated share gains with a novel coated PICC portfolio and new product introductions.

Image Source: Zacks Investment Research

In June 2023, Teleflex’s Arrow EZ-IO Needle became the first and only Intraosseous (IO) Needle to receive FDA 510(k) clearance for MR Conditional labeling. A critical component of the Arrow EZ-IO Intraosseous Vascular Access System, The EZ-IO Needle, has a patented diamond tip designed for fast, precise and steady insertion.

Solid Momentum in Interventional: In the third quarter of 2023, the segment’s diversified portfolio generated 22.4% revenue growth. Balloon pumps, right heart catheters and access and closure and MANTA, the Vascular Closure device, all contributed meaningfully. MANTA continues on the trajectory for strong double-digit growth in 2023.

Earlier this year, Teleflex received FDA clearance for Wattson Temporary Pacing Guidewire, expanding the Structural Heart Portfolio with the first commercially available bipolar temporary pacing guidewire designed specifically for use during transcatheter aortic valve replacement and balloon aortic valvuloplasty. Per the latest update, the company is in the final stages of completion for the commercial launch.

Strong Solvency With High Leverage: Teleflex exited the third quarter of 2023 with cash and cash equivalents of $881.5 million against the corresponding near-term payable of $87.5 million. With such an insignificant comparison, the company holds a sound financial position, even during times of economic slowdown. The long-term debt amounted to $1.95 billion at the end of the third quarter, higher than $1.47 billion at the second-quarter end. Meanwhile, times interest earned for the company stands at 7.2%, down from 7.6% in the second quarter.

Downsides

Escalating Expenses Put Pressure on the Bottom Line: Teleflex has been grappling with escalated expenses for a while. Deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor costs, as well as freight charges and rising interest rates, all have put the medical device space in a tight spot. In the third quarter of 2023, Teleflex’s gross margin contracted 134 basis points (bps) to 55.8%. SG&A expenses rose 1.7%, while research and development expenses increased 0.5%.

Increasing Competition: Teleflex competes with companies ranging from small start-up enterprises to larger and more established companies that have access to significantly greater financial resources. Moreover, competitors having clinical superiority and innovative features that enhance patient benefit, product reliability, performance, customer and sales support and cost-effectiveness can be a disadvantage for the company.

Estimate Trend

The Zacks Consensus Estimate for TFX’s 2023 earnings per share (EPS) has moved north from $13.27 to $13.33 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $2.96 billion. This suggests a 6.2% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM.

Haemonetics has an estimated earnings growth rate of 28.4% for fiscal 2024 compared with the industry’s 15.3%. HAE’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 16.1%. Its shares have decreased 1.3% compared with the industry’s 3.1% fall in the past year.

HAE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Insulet, sporting a Zacks Rank #1 at present, has a long-term estimated earnings growth rate of 39.2% compared with the industry’s 11.7%. Shares of the company have decreased 34.9% compared with the industry’s 3.1% decline over the past year.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.5%.

DexCom, carrying a Zacks Rank #2 at present, has an estimated long-term earnings growth rate of 33.6% compared with the industry’s 13.8%. Shares of DXCM have increased 3.3% against the industry’s 3.3% decline over the past year.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report