Here's Why You Should Retain Vornado Realty (VNO) Stock Now

Vornado Realty Trust VNO, with its top-quality office properties strategically located in exclusive markets, such as New York, Chicago and San Francisco, is poised to benefit from tenants’ healthy demand for premier office spaces with class-apart amenities. However, amid macroeconomic uncertainties, choppy office market conditions could temporarily dampen the leasing activity to a certain level. Also, elevated interest rates pose a concern for the company.

What’s Aiding it?

Vornado's focus on having assets in a few select high-rent, high-barrier-to-entry markets, along with a diversified tenant base, is expected to drive steady cash flows and ensure long-term growth.

The office-using job growth, enhanced space efficiency and the expansion of technology, finance and media firms are set to bolster rental revenues in the upcoming periods. New York continues to attract office occupiers aiming to expand their workspace.

Rents in recently constructed or excellently redeveloped assets featuring ample amenities in well-connected areas have risen. Vornado, adept at providing premium office spaces through its redevelopment efforts, is poised to capitalize on this emerging trend.

With a focus on enhancing its primary operations, Vornado is actively engaged in opportunistic expansions and divestitures, along with strategic business spin-offs. These strategic divestitures furnish the company with the necessary resources to reinvest in opportunistic development and revitalization projects. VNO closed the sale of four Manhattan retail properties in August 2023 for $100 million. In July 2023, it disposed of The Armory Show in New York for $24.4 million.

Vornado enjoys a healthy balance sheet strength. As of Sep 30, 2023, the company had $3.2 billion of liquidity. Further, VNO has been securing loan refinancing in recent times, enabling it to reduce interest rates on borrowings and extend debt maturities. A flexible financial position will enable it to take advantage of future investment opportunities and fund its development projects.

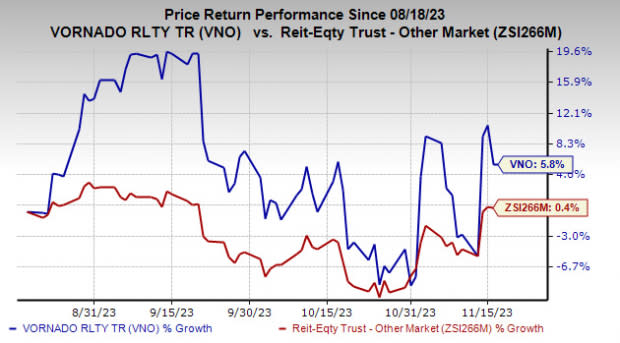

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 5.8% compared with the industry’s rise of 0.4%.

Image Source: Zacks Investment Research

What’s Hurting it?

Persistent macroeconomic uncertainties and choppy office market conditions are expected to dampen the demand for office properties in the near term, subsequently impacting leasing activity to a certain level.

Vornado is troubled by the current high interest rate setting. Elevated rates result in significant borrowing expenses for the company, impacting its capacity to acquire or develop real estate assets. With a substantial debt load, Vornado's share of total debt as of Sep 30, 2023, amounted to nearly $10.3 billion. Per management, high interest expenses during the third quarter of 2023 marred the company’s FFO per share growth.

Solid dividend payouts remain the biggest attraction for REIT investors. However, in January 2023, VNO announced a 29.2% cut in its quarterly cash dividend per share from 53 cents to 37.50 cents. The dividend cut was a result of Vornado’s reduced projected 2023 taxable income, mainly due to higher interest expenses. Further, in April 2023, the company postponed its dividend payment until the end of this year. At the end of 2023, depending upon its taxable income for the year, it will pay the dividend in either cash or a combination of cash and securities.

Stocks to Consider

Some better-ranked stocks from the REIT sector are Welltower WELL, EastGroup Properties EGP and Stag Industrial STAG. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Welltower’s current-year FFO per share has moved marginally northward over the past week to $3.58.

The Zacks Consensus Estimate for EastGroup’s 2023 FFO per share has moved marginally upward in the past week to $7.69.

The Zacks Consensus Estimate for Stag’s ongoing year’s FFO per share has been raised upward over the past month to $2.28.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vornado Realty Trust (VNO) : Free Stock Analysis Report

Stag Industrial, Inc. (STAG) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report