Here's Why Retaining ICF International (ICFI) is a Wise Move

ICF International, Inc. ICFI is gaining from contract wins, which are expected to have a positive impact on the company’s performance. Acquisitions enable the company to expand and increase its global footprint.

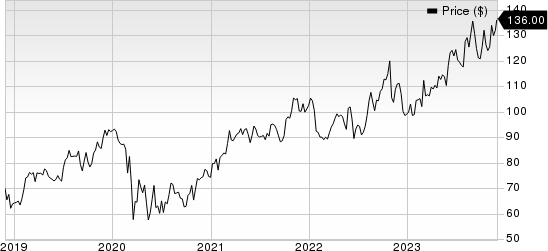

ICF shares have gained 37.3% and 23.4% in the year-to-date period and in the trailing 12-month period.

ICF International, Inc. Price

ICF International, Inc. price | ICF International, Inc. Quote

Factors That Bode Well

ICF International has recently won a number of contracts, which are expected to bolster the company’s performance going forward. ICFI has secured multiple government task orders, including a $32 million DHS/ICE contract to modernize homeland security investigations systems using ServiceNow's low-code platform.

Another $36 million task order from DHS focuses on revamping ICE's human resources technology with transparency and accountability. The Department of Housing and Development awarded ICFI with multimillion-dollar cooperative agreements for community development, technology and analytics services. NIH/NLM granted the company $31 million for biomedical expertise, data management and digital modernization.

ICF International prioritizes acquisitions in its growth strategy. In 2022, the company acquired SemanticBits, a Virginia-based digital modernization solutions provider for federal health agencies. The acquisition added synergies and scalability for advanced IT solutions.

The acquisition of Creative Systems and Consulting in January 2022 is poised to enhance the company's federal IT modernization and digital transformation capabilities, particularly with proficient Salesforce and Microsoft implementation teams. Similarly, the January 2020 acquisition of Incentive Technology Group has strengthened ICF's IT modernization services for U.S. federal government clients, introducing top-tier IT platform expertise and partnerships.

Factors Against

ICF is grappling with escalating costs, primarily driven by substantial investments in internal infrastructure and acquisitions. The company's operating costs and expenses surged 16.1% in 2022, 3.9% in 2021 and experienced a 5.1% year-over-year increase in 2020. This financial strain highlights the challenges posed by the rising expenditure, thus potentially impacting the company's overall financial performance and profitability.

ICFI currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector that may be considered:

Gartner IT:The Zacks Consensus Estimate of Gartner’s 2023 revenues indicates 7.9% growth from the year-ago figure while earnings are expected to decline 1.9%. The company has beaten the consensus estimate in all the past four quarters, with an average surprise of 34.4%.

IT sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

FTI ConsultingFCN:The Zacks Consensus Estimate of FCN’s 2023 revenues indicate 12.1% growth from the year-ago figure while earnings are expected to grow 3.4%. The company has beaten the consensus estimate in three of the four quarters and missed on one instance, the average surprise being 8.5%.

FCN currently has a Zacks Rank #2 (Buy).

Broadridge Financial Solutions BR:The Zacks Consensus Estimate of Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago figure while earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR presently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report