Here's Why Shanghai Jin Jiang Capital (HKG:2006) Has A Meaningful Debt Burden

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Shanghai Jin Jiang Capital Company Limited (HKG:2006) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Shanghai Jin Jiang Capital

What Is Shanghai Jin Jiang Capital's Net Debt?

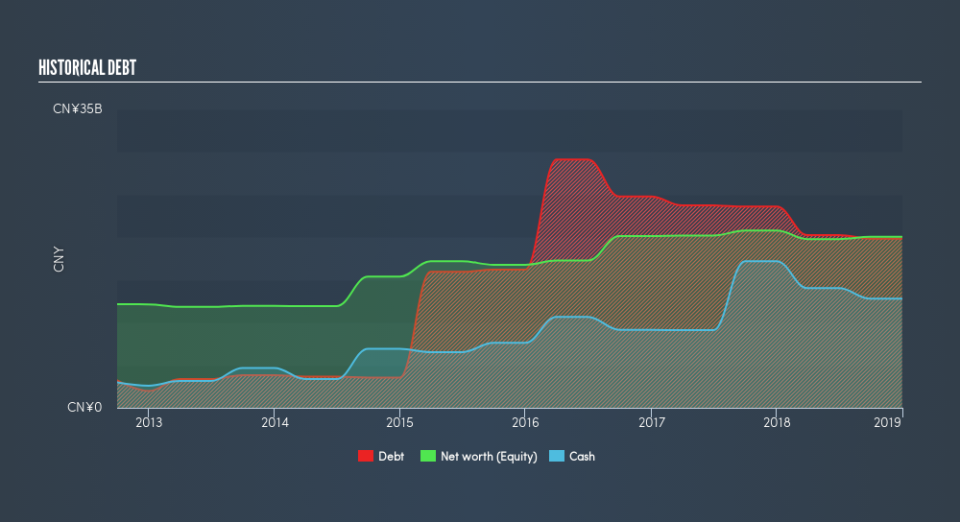

As you can see below, Shanghai Jin Jiang Capital had CN¥19.8b of debt at December 2018, down from CN¥23.8b a year prior. However, it also had CN¥12.8b in cash, and so its net debt is CN¥7.05b.

How Strong Is Shanghai Jin Jiang Capital's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Shanghai Jin Jiang Capital had liabilities of CN¥15.7b due within 12 months and liabilities of CN¥21.5b due beyond that. Offsetting this, it had CN¥12.8b in cash and CN¥2.67b in receivables that were due within 12 months. So it has liabilities totalling CN¥21.7b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥6.11b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Shanghai Jin Jiang Capital would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Shanghai Jin Jiang Capital has net debt worth 2.2 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.0 times the interest expense. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Unfortunately, Shanghai Jin Jiang Capital saw its EBIT slide 5.1% in the last twelve months. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Shanghai Jin Jiang Capital can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Shanghai Jin Jiang Capital actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Mulling over Shanghai Jin Jiang Capital's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Shanghai Jin Jiang Capital stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.