Here's Why Skechers (SKX) Stock Has Rallied 50.6% in a Year

Skechers U.S.A., Inc. SKX appears commendable on the back of its robust business strategies. The company remains focused on boosting its omnichannel capabilities by expanding its direct-to-consumer (DTC) business and enhancing its international foothold. SKX has been making strategic investments to improve its worldwide infrastructure, primarily in the e-commerce platforms and distribution centers.

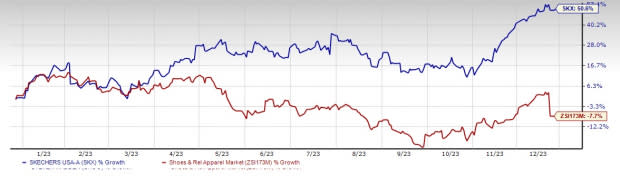

Continued global demand for its comfort technology footwear is also yielding results. Shares of this footwear leader have appreciated 50.6% against the industry’s 7.7% drop in the past year. This upside run is buoyed by the aforesaid tailwinds.

Let’s Dive Deeper

Skechers has been directing resources to enhance its digital capabilities, which include augmenting website features, mobile applications and loyalty programs. Investments made to integrate store and digital ecosystems for developing a seamless omnichannel experience are likely to drive greater sales. The company has updated its point-of-sale systems to better engage with customers, both offline and online.

Initiatives such as “Buy Online, Pick-Up in Store” and “Buy Online, Pickup at Curbside” are worth mentioning. Moreover, the company has been enhancing its distribution facilities and supply-chain capabilities. These investments highlight Skechers’ progress as an omnichannel retailer. The company has been enhancing its online presence for a while by further investing in digital and omnichannel capabilities. We note that the acquisition of its Scandinavia distributor has helped the company build its brand in the Nordic region with stores and e-commerce platforms and a network of wholesale customers in Finland, Sweden, Denmark and Norway.

Image Source: Zacks Investment Research

Strength in the company's DTC business has been aiding its performance. The company’s DTC sales increased 23.8% year over year in the third quarter of 2023, following 29.1% growth in the preceding quarter. Results gained from strength in brands and demand for comfort technology products, aided by solid marketing and distribution capabilities. During the third quarter, Skechers’ DTC sales totaled $850.4 million, accounting for 42% of its total sales.

We note that sturdy demand for comfort technology footwear, enhanced in-store product availability and effective demand creation resulted in its impressive growth. These positives collectively boosted the company's overall revenues in the third quarter.

Management also remains focused on store expansion. In the third quarter, management opened 72 company-owned stores while closing 23 stores. Store openings consisted of 43 in China, five big box stores in the United States, four in South Korea, five in Vietnam, three each in Chile and India, two each in Israel, France and Hong Kong and one each in Canada, Peru and Colombia. Also, in the same period, 324 third-party stores were opened, including 11 in India and 282 in China, bringing the total number of third-party stores to 3,399 and the total worldwide Skechers store count to 4,992. Fourth quarter to date, the company has introduced three company-owned stores in the United States and one each in the UK, Chile and Colombia. For the rest of the year, it intends to open 45-55 company-owned stores worldwide.

Management also remains focused on store expansion. In the second quarter of 2023, management opened 50 company-owned stores while closing 39 stores. Store openings consisted of 28 in China, eight of which were transferred from franchise to company-owned, eight big box stores in the United States, and three each in Chile and Vietnam. Also, it added 56 Skechers outlets in four Nordic countries and two stores in Germany from the acquisition of the company’s Scandinavian distributor. Furthermore, Skechers’ international business remains a significant sales growth driver.

Analysts seem optimistic about the stock. The Zacks Consensus Estimate for Skechers’ 2024 sales and earnings per share (EPS) is currently pegged at $8.9 billion and $3.99 each, suggesting respective growth of 10% and 16.1% from the corresponding year-ago reported figures.

To wrap up, this Zacks Rank #3 (Hold) company is likely to continue performing well on the back of such sturdy endeavors. A VGM Score of B further speaks volumes.

Eye These Solid Picks

Some better-ranked companies are Royal Caribbean RCL, lululemon athletica LULU and Ralph Lauren RL.

Royal Caribbean sports a Zacks Rank #1 (Strong Buy), at present. RCL has a trailing four-quarter earnings surprise of 28.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates increases of 57.7% and 187.9%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy), at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 18.2% and 22.9%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.2%, on average.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank of 2 at present. RL has a trailing four-quarter earnings surprise of 18%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 1.4% and 13.1%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report