Here's Why Snap-On (SNA) is Marching Ahead of Its Industry

Snap-On SNA has been gaining from a continued positive business momentum and contributions from its Value Creation plan. This led to the impressive second-quarter 2023 results, wherein the top line beat the Zacks Consensus Estimate for the 13th consecutive quarter and the bottom line marked the 12th straight earnings beat.

Earnings of $4.89 per share in second-quarter 2023 improved 14.5% from the $4.27 reported in the prior-year quarter. Net sales grew 4.8% year over year to $1,191.3 million. The increase can be attributed to organic sales growth of 5.6%.

Also, higher sales volumes and pricing actions, lower material and other costs, and gains from the company's RCI initiatives boosted margins in the said quarter. In the second quarter, the company’s gross profit of $603.7 million improved 9.1% year over year, while the gross margin expanded 200 basis points (bps) year over year to 50.7%. This is in sync with our estimate of gross margin expansion of 130 bps.

The company’s operating earnings before financial services totaled $277 million, up 12.3% year over year. As a percentage of sales, operating earnings before financial services expanded 160 bps to 23.3% in the second quarter. Financial Services' operating earnings were $66.9 million in the quarter, up 2.5% year over year. Consolidated operating earnings (including financial services) were $343.9 million, up 10.3% year over year. As a percentage of sales, operating earnings expanded 130 bps year over year to 26.8%.

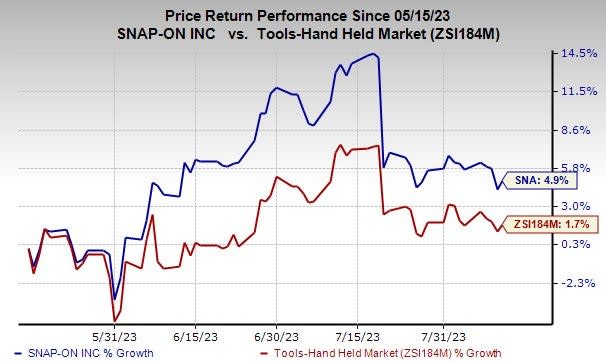

Consequently, shares of this Zacks Rank #3 (Hold) company have gained 4.9% in the past three months compared with the industry’s growth of 1.7%.

Image Source: Zacks Investment Research

SNA is dedicated to various strategic principles and processes aimed at creating value in areas like RCI. The RCI process is designed to enhance organizational effectiveness and minimize costs, beside helping Snap-on boost sales and margins, and generate savings. Savings from the RCI initiative reflect gains from the continuous productivity and process improvement plans.

Management intends to boost customer services, along with enhancing manufacturing and supply-chain capabilities through the RCI initiatives and further investments. Apart from this, Snap-on’s ability to innovate bodes well. The company has also been investing in new products and increasing brand awareness across the world.

The company is comfortably funding shareholder cash distributions at their current level, has sufficient financial health, and produces plenty of cash to meet its financial obligations. In the quarter under review, it approved a quarterly dividend of $1.62 per share, payable Jun 9, of shareholders’ record as of May 19.

In second-quarter 2023, it paid out dividends of $85.9 million and repurchased 359,000 shares worth $94.8 million under its existing share repurchase programs. As of Jul 1, 2023, the company had $336.7 million remaining under its existing authorizations.

Headwinds to Overcome

Snap-on has been reeling under macroeconomic headwinds, which are likely to persist in 2023. Rising cost inflation, stemming from higher raw material expenses and other costs, is likely to be a deterrent. Also, the unfavorable currency is concerning.

Wrapping Up

Although the ongoing macroeconomic headwinds are likely to persist in 2023, there are plenty of reasons to be bullish about SNA’s fundamentals. Its forward price-to-earnings ratio of 14.65 has underperformed the industry’s ratio of 18.04, which raises optimism about the stock.

Topping it, a Momentum Score of B and a long-term earnings growth rate of 8% reflect its inherent strength. The Zacks Consensus Estimate for Snap-on’s 2023 earnings for the current financial year has risen 3.8% in the past 30 days.

Stocks to Consider

Some better-ranked companies are Royal Caribbean RCL, lululemon athletica LULU and G-III Apparel GIII.

Royal Caribbean sports a Zacks Rank #1 (Strong Buy) at present. RCL has a trailing four-quarter earnings surprise of 26.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates increases of 47.9% and 158.3%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank of 2 (Buy) at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 16.7% and 18%, respectively, from the year-ago reported figures. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

G-III Apparel is a leading designer and distributor of women's and men's apparel in the United States, which currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for G-III Apparel’s current financial-year sales suggests growth of 1.9%. Its earnings per share are expected to rise 0.4% from the year-ago reported figure. GIII has a trailing four-quarter earnings surprise of 47.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Snap-On Incorporated (SNA) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report