Here's Why Sprouts Farmers (SFM) is Staying Ahead of Industry

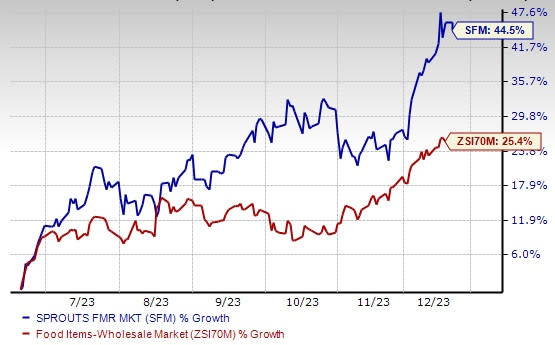

Sprouts Farmers Market, Inc. SFM, one of the recognized names in the grocery space, has exhibited an impressive run on the bourses in the past six months on strategies, such as enhancing omni-channel solutions, a widening customer base and emphasizing private-label products. Shares of this Zacks Rank #3 (Hold) company have gained 44.5% in the past six months compared with the industry’s growth of 25.4%.

An uptrend in the Zacks Consensus Estimate echoes the same sentiment. The consensus estimates for current financial year 2023 and 2024 have increased 1.5% and 0.4% to $2.79 and $2.82, respectively, over the past 60 days.

Image Source: Zacks Investment Research

Let’s Dig in Deeper

Sprouts Farmers is actively working to enhance and integrate its customer experience broadly. The company's strategy to grow its customer base involves a combination of product innovation, improved customer experiences, targeted marketing with competitive pricing and technological improvements.

To cater to the increasing preference for convenience, the company is broadening its range of products to include items that are ready-to-eat, ready-to-heat and ready-to-cook. Additionally, Sprouts Farmers is boosting its private-label offerings across various categories.

Through strategic partnerships with Instacart and DoorDash, the company has accessed new markets, significantly boosting its e-commerce sector. This approach has paid off, as evidenced by a notable 16% year-over-year increase in e-commerce sales in the third quarter of 2023, accounting for 12.1% of the total sales.

In an aggressive push for revenue growth, Sprouts Farmers Market opened 10 stores in the third quarter. In its last reported quarter’s earnings call, management highlighted that it would open 30 stores in 2023 and an additional 35 in 2024, mostly in the latter half of the year.

The company is focusing on smaller store formats, a strategic decision aimed at increasing profitability, especially in key areas like produce and frozen goods. This strategy is in line with Sprouts Farmers' goal of achieving a 10% annual growth rate in units starting in 2024.

Positive Prospects - Another Key Factor

Courtesy of a solid momentum, Sprouts Farmers appears well-positioned. The company expects a 3% rise in comparable store sales and a solid 6.5-7% increase in net sales in 2023. Consequently, the management recently raised its 2023 adjusted earnings before interest and taxes forecast to $387-$393 million, up from the previously mentioned $378-$390 million.

This revised forecast suggests 8.6% year-over-year growth in adjusted operating income. Additionally, Sprouts Farmers anticipates its full-year adjusted earnings per share to reach $2.77-$2.81, suggesting a significant jump from the $2.39 reported in 2022.

3 Promising Stocks

We have highlighted three better-ranked stocks, namely Casey's General Stores, Inc. CASY, Ollie's Bargain Outlet Holdings, Inc. OLLI and Sovos Brands Inc. SOVO.

Casey's offers a comprehensive range of products and services to meet the needs of its customers. The company currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Casey's current fiscal-year sales and EPS suggests growth of 0.7% and 6.2%, respectively, from the year-ago reported figures. CASY has a trailing four-quarter earnings surprise of 17.8%, on average.

Ollie's Bargain Outlet is a value retailer of brand-name merchandise at drastically reduced prices. The company currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Ollie's Bargain Outlet’s current fiscal-year sales and EPS suggests growth of 14.8% and 72.8%, respectively, from the year-ago reported figures. OLLI has a trailing four-quarter earnings surprise of 7%, on average.

Sovos Brands is a food company. Its brand portfolio includes Rao's, a premium line of pasta sauces, pizza sauces, dry pastas, frozen entrees and soups. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Sovos Brands’ current financial-year sales and earnings suggests growth of 13.4% and 25%, respectively, from the year-ago reported numbers. SOVO has a trailing four-quarter earnings surprise of 21.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Sovos Brands, Inc. (SOVO) : Free Stock Analysis Report