Here's Why You Should Stay Invested in AXIS Capital (AXS)

AXIS Capital Holdings Limited’s AXS compelling and diversified product portfolio, underwriting excellence, digital capabilities, solid capital position and favorable growth estimates make it worth retaining in one’s portfolio.

Axis Capital has a decent record of delivering an earnings surprise in three of the last four quarters while missing in the other one. Earnings have grown 39% in the past five years, better than the industry average of 17%

This leading specialty insurer and global reinsurer, aiming leadership in specialty risks has a VGM Score of A. This helps to identify stocks with the most attractive value, growth and momentum.

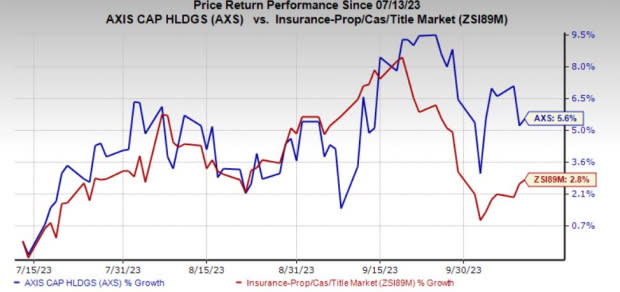

Zacks Rank & Price Performance

AXS currently has a Zacks Rank #3 (Hold). In the past three months, the stock has gained 5.6% compared with the industry’s increase of 2.8%.

Image Source: Zacks Investment Research

Optimistic Growth Projection

The Zacks Consensus Estimate for 2023 earnings is pegged at $8.59, indicating an increase of 47.9% on 7.2% higher revenues of $5.7 billion. The consensus estimate for 2024 earnings is pegged at $9.26, indicating an increase of 7.8% on 4.3% higher revenues of $5.9 billion.

The expected long-term earnings growth rate is pegged at 5%.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2023 and 2024 earnings has moved 4.2% and 0.2% north, respectively, in the past 60 days, reflecting analyst optimism.

Business Tailwinds

AXS’ insurance business should benefit from a diversified portfolio of global specialty business, leadership positions and growth opportunities across major business lines. The Reinsurance business should benefit from strong cycle management that focuses on improving the business mix. The lines of business, on average, witnessed a double-digit rate increase.

The insurer’s growth initiatives bode well. While earnings volatility lowered due to AXS’ exit from the Reinsurance Catastrophe and Property business, marine Cargo, Cyber and Renewable Energy provide strong double-digit return on equity opportunities.

Axis Capital has a solid capital position that supports effective capital deployment. While the insurer prioritizes investing in growth initiatives that ramp up specialty businesses, it has also hiked its dividend for 18 consecutive years at an eight-year CAGR (2015 – 2022) of 5.3%. Its dividend yield is currently 3.2%, way above the industry average of 0.3%. The insurer boasts one of the highest dividend yields among its peers.

This apart, AXS also has a $100 million share buyback remaining under its authorization for this year.

Stocks to Consider

Some top-ranked stocks from the property and casualty insurance industry are ProAssurance Corporation PRA, Cincinnati Financial Corporation CINF and Chubb Limited CB. ProAssurance currently sports a Zacks Rank #1 (Strong Buy), while Cincinnati Financial and Chubb carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

ProAssurance has a decent record of beating earnings estimates in two of the last four quarters and missing twice. PRA has gained 0.3% so far this year.

The Zacks Consensus Estimate for PRA’s 2024 earnings per share is pegged at 83 cents, indicating a year-over-year jump of 143.5%.

Cincinnati Financial has a decent track record of beating earnings estimates in three of the last four quarters and missing once, the average beat being 25.25%. Year to date, CINF has lost 0.1%.

The Zacks Consensus Estimate for CINF’s 2023 and 2024 earnings per share is pegged at $5.01 and $5.88, suggesting year-over-year growth of 18.2% and 17.5%, respectively.

Chubb has a solid record of beating earnings estimates in three of the last four quarters and missing in one, the average beat being 3.36%. Year to date, CB has lost 4.7%.

The Zacks Consensus Estimate for CB’s 2023 and 2024 earnings per share is pegged at $18.18 and $19.86, implying year-over-year increases of 19.3% and 9.2%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

ProAssurance Corporation (PRA) : Free Stock Analysis Report