Here's Why You Should Steer Clear of Nordson (NDSN) Stock

Nordson Corporation NDSN has been grappling with weakness in the Industrial Precision Solutions segment and rising cost of sales.

The Industrial Precision Solutions is being affected by the softness in the product assembly and nonwoven product lines in the Asia region. A decrease in electronics dispensing product lines serving in semiconductor end markets, mainly in the Asia Pacific region, has been a drag on the Advanced Technology Solutions segment.

Nordson, carrying a Zacks Rank #4 (Sell), has also been seeing weakness in the medical fluid components and fluid solutions product lines within the Medical and Fluid Solutions segment.

Due to these headwinds, Nordson has narrowed its fiscal 2023 revenue guidance. The company now expects year-over-year revenue growth of 0-2% in fiscal 2023 compared with 0-3% predicted earlier.

Nordson has been dealing with the adverse impacts of high cost of sales due to rising inflation. Cost of sales increased 2.9% in the first nine months of fiscal 2023. In the first nine months of fiscal 2023, NDSN’s gross margin decreased 130 basis points due to reduced manufacturing efficiency and severance in sites dealing with significant volume decreases and incremental inventory.

Given Nordson’s international exposure, foreign currency headwinds are weighing on its top line. Foreign exchange headwinds hurt total revenues by 1.8% in the first nine months of fiscal 2023. Being the most globally diverse, the Industrial precision solution segment is highly exposed to foreign currency headwinds. In the first nine months of fiscal 2023, unfavorable currency movements had an impact of 2.2% on the segment's revenues.

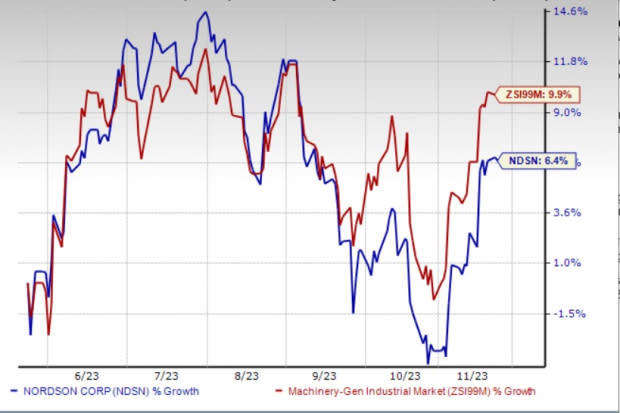

Amid the abovementioned headwinds, shares of Nordson have underperformed its industry in the past six months. The stock has gained 6.4% in the period compared with the industry’s 9.9% increase.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Nordson’s fiscal 2023 earnings has been revised downward by a penny in the past 60 days. The same for fiscal 2024 earnings has been revised downward by 0.7% in the past 60 days.

Key Picks

Below, we discuss some better-ranked stocks.

A. O. Smith Corporation AOS presently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter earnings surprise of 14%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A. O. Smith has an estimated earnings growth rate of 20.1% and 6.1% for 2023 and 2024, respectively. Shares of the company have gained 32.6% in the year-to-date period.

ITT ITT presently carries a Zacks Rank #2. The company pulled off a trailing four-quarter earnings surprise of 8%, on average.

ITT has an estimated earnings growth rate of 16.7% and 11.2% for 2023 and 2024, respectively. Shares of the company have gained 30.8% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report