Here's Why Texas Pacific Land (NYSE:TPL) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Texas Pacific Land (NYSE:TPL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Texas Pacific Land with the means to add long-term value to shareholders.

Check out our latest analysis for Texas Pacific Land

How Quickly Is Texas Pacific Land Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Texas Pacific Land has grown EPS by 23% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

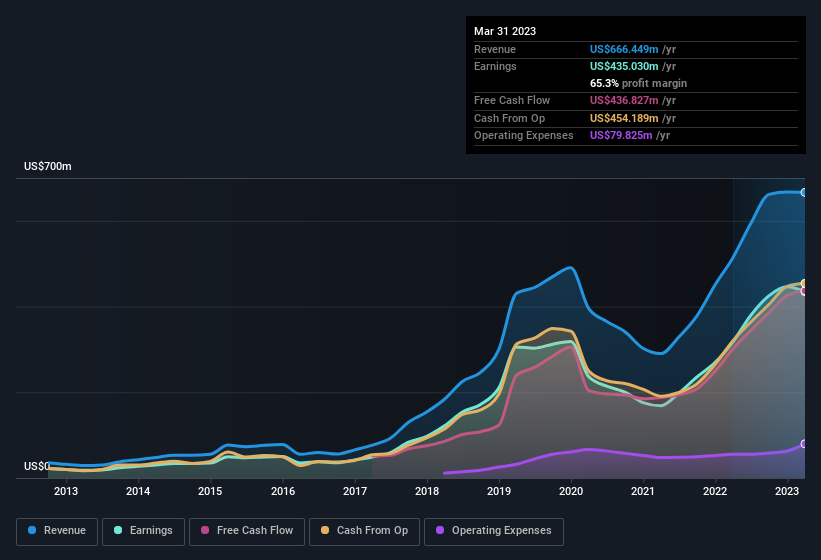

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Texas Pacific Land remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 30% to US$666m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Texas Pacific Land Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One shining light for Texas Pacific Land is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Independent Trustee Murray Stahl paid US$16k, for stock at US$2,618 per share. It doesn't get much better than that, in terms of large investments from insiders.

The good news, alongside the insider buying, for Texas Pacific Land bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$13m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Tyler Glover, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Texas Pacific Land, with market caps over US$8.0b, is about US$12m.

Texas Pacific Land offered total compensation worth US$6.3m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Texas Pacific Land Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Texas Pacific Land's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. Now, you could try to make up your mind on Texas Pacific Land by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Keen growth investors love to see insider buying. Thankfully, Texas Pacific Land isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here