Here's Why We Think Arbuthnot Banking Group (LON:ARBB) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Arbuthnot Banking Group (LON:ARBB). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Arbuthnot Banking Group

How Fast Is Arbuthnot Banking Group Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Arbuthnot Banking Group grew its EPS from UK£0.36 to UK£2.05, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

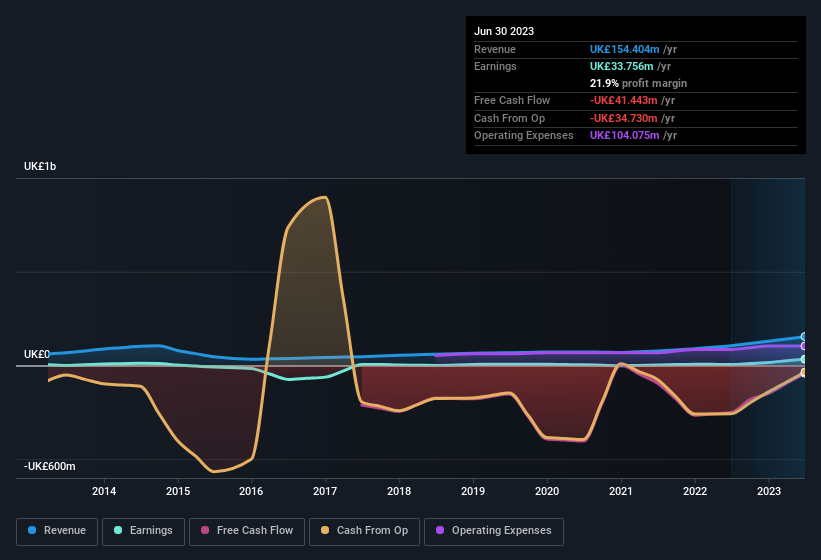

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Arbuthnot Banking Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Arbuthnot Banking Group maintained stable EBIT margins over the last year, all while growing revenue 46% to UK£154m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Arbuthnot Banking Group is no giant, with a market capitalisation of UK£175m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Arbuthnot Banking Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold UK£296k worth of shares. But that's far less than the UK£1.1m insiders spent purchasing stock. This adds to the interest in Arbuthnot Banking Group because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was Chairman & CEO Henry Angest who made the biggest single purchase, worth UK£682k, paying UK£9.75 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Arbuthnot Banking Group insiders own more than a third of the company. To be exact, company insiders hold 61% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at UK£106m at the current share price. So there's plenty there to keep them focused!

Should You Add Arbuthnot Banking Group To Your Watchlist?

Arbuthnot Banking Group's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Arbuthnot Banking Group deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Arbuthnot Banking Group (at least 1 which is concerning) , and understanding them should be part of your investment process.

The good news is that Arbuthnot Banking Group is not the only growth stock with insider buying. Here's a list of growth-focused companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.