Here's Why We Think Cahya Mata Sarawak Berhad (KLSE:CMSB) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Cahya Mata Sarawak Berhad (KLSE:CMSB). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Cahya Mata Sarawak Berhad

How Fast Is Cahya Mata Sarawak Berhad Growing Its Earnings Per Share?

Over the last three years, Cahya Mata Sarawak Berhad has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Cahya Mata Sarawak Berhad's EPS shot up from RM0.18 to RM0.24; a result that's bound to keep shareholders happy. That's a impressive gain of 30%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Cahya Mata Sarawak Berhad shareholders can take confidence from the fact that EBIT margins are up from -2.0% to 0.2%, and revenue is growing. That's great to see, on both counts.

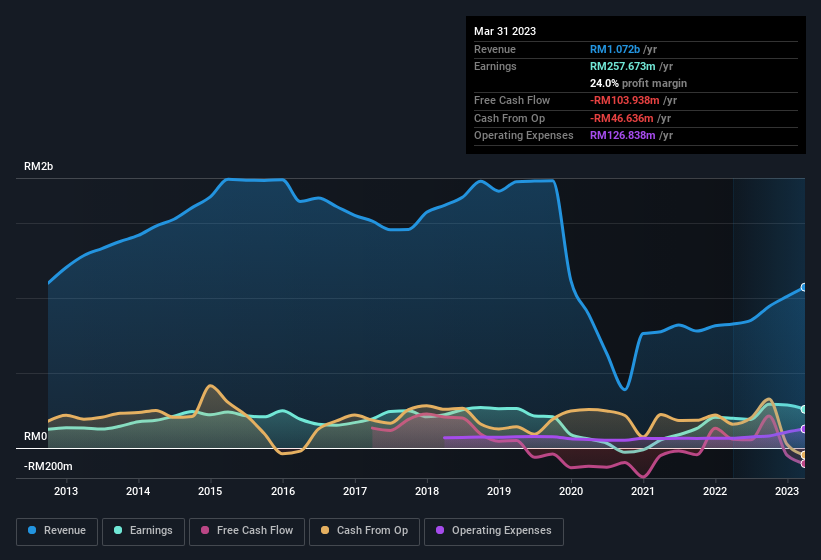

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Cahya Mata Sarawak Berhad's future EPS 100% free.

Are Cahya Mata Sarawak Berhad Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Cahya Mata Sarawak Berhad insiders have a significant amount of capital invested in the stock. Indeed, they hold RM166m worth of its stock. This considerable investment should help drive long-term value in the business. Those holdings account for over 14% of the company; visible skin in the game.

Should You Add Cahya Mata Sarawak Berhad To Your Watchlist?

You can't deny that Cahya Mata Sarawak Berhad has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Cahya Mata Sarawak Berhad's continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Cahya Mata Sarawak Berhad (1 is potentially serious) you should be aware of.

Although Cahya Mata Sarawak Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here