Here's Why I Think CF Bankshares (NASDAQ:CFBK) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like CF Bankshares (NASDAQ:CFBK). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for CF Bankshares

CF Bankshares's Improving Profits

Over the last three years, CF Bankshares has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, CF Bankshares's EPS soared from US$3.00 to US$4.08, in just one year. That's a impressive gain of 36%.

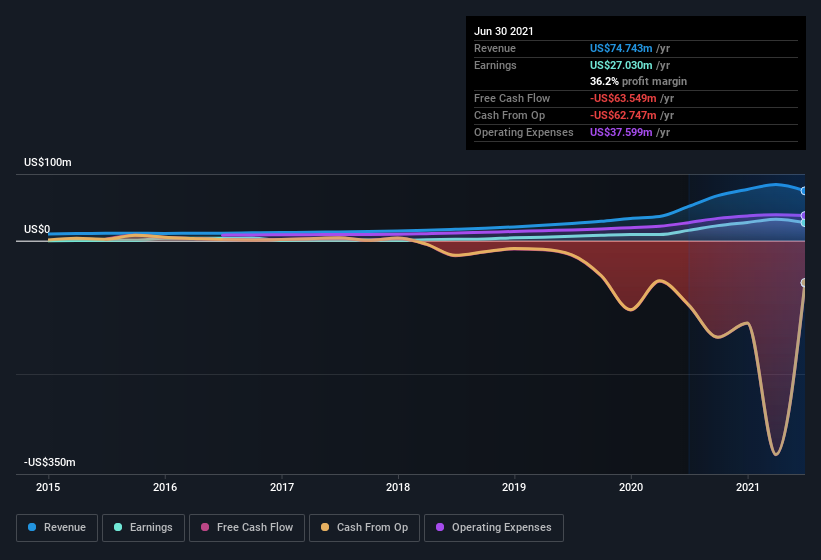

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of CF Bankshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. CF Bankshares maintained stable EBIT margins over the last year, all while growing revenue 45% to US$75m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

CF Bankshares isn't a huge company, given its market capitalization of US$131m. That makes it extra important to check on its balance sheet strength.

Are CF Bankshares Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that CF Bankshares insiders spent US$122k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the President, Timothy O’Dell, who made the biggest single acquisition, paying US$38k for shares at about US$19.00 each.

Along with the insider buying, another encouraging sign for CF Bankshares is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$16m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 12% of the company, demonstrating a degree of high-level alignment with shareholders.

Is CF Bankshares Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about CF Bankshares's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with CF Bankshares , and understanding them should be part of your investment process.

The good news is that CF Bankshares is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.