Here's Why We Think Clinuvel Pharmaceuticals (ASX:CUV) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Clinuvel Pharmaceuticals (ASX:CUV). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Clinuvel Pharmaceuticals

How Quickly Is Clinuvel Pharmaceuticals Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Clinuvel Pharmaceuticals' EPS has grown 21% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Clinuvel Pharmaceuticals' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Clinuvel Pharmaceuticals shareholders can take confidence from the fact that EBIT margins are up from 55% to 57%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

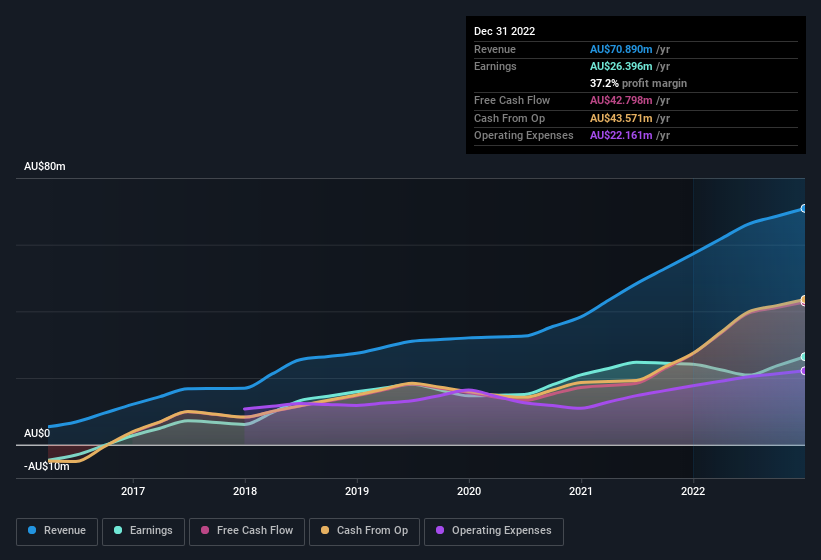

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Clinuvel Pharmaceuticals?

Are Clinuvel Pharmaceuticals Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Clinuvel Pharmaceuticals insiders have a significant amount of capital invested in the stock. With a whopping AU$126m worth of shares as a group, insiders have plenty riding on the company's success. That holding amounts to 13% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Is Clinuvel Pharmaceuticals Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Clinuvel Pharmaceuticals' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Clinuvel Pharmaceuticals' continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. If you think Clinuvel Pharmaceuticals might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Although Clinuvel Pharmaceuticals certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here