Here's Why We Think Colabor Group (TSE:GCL) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Colabor Group (TSE:GCL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Colabor Group

How Fast Is Colabor Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Colabor Group has grown EPS by 16% per year. That's a good rate of growth, if it can be sustained.

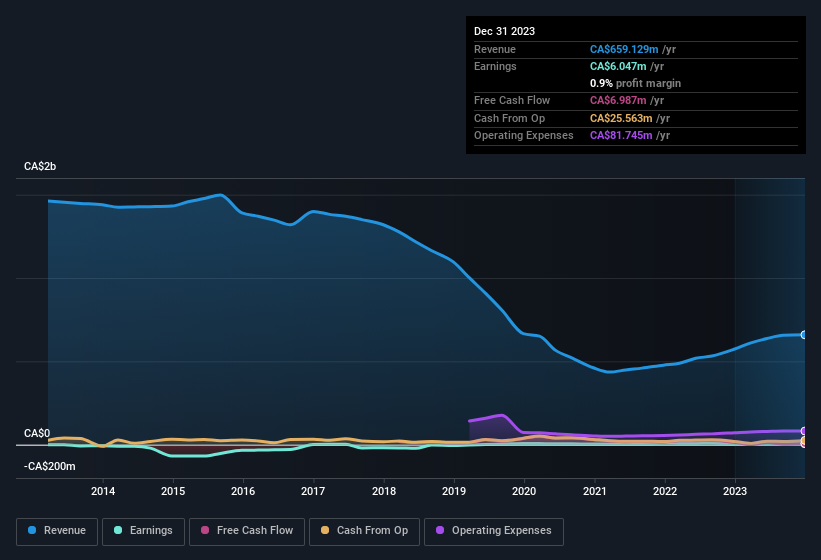

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Colabor Group achieved similar EBIT margins to last year, revenue grew by a solid 15% to CA$659m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Colabor Group is no giant, with a market capitalisation of CA$123m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Colabor Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Colabor Group insiders refrain from selling stock during the year, but they also spent CA$203k buying it. This is a good look for the company as it paints an optimistic picture for the future. It is also worth noting that it was Senior VP & CFO Pierre Blanchette who made the biggest single purchase, worth CA$95k, paying CA$0.76 per share.

The good news, alongside the insider buying, for Colabor Group bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$32m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 26% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Colabor Group To Your Watchlist?

As previously touched on, Colabor Group is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Colabor Group (1 can't be ignored) you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Colabor Group isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.