Here's Why I Think Community Trust Bancorp (NASDAQ:CTBI) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Community Trust Bancorp (NASDAQ:CTBI). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Community Trust Bancorp

Community Trust Bancorp's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years Community Trust Bancorp grew its EPS by 12% per year. That's a good rate of growth, if it can be sustained.

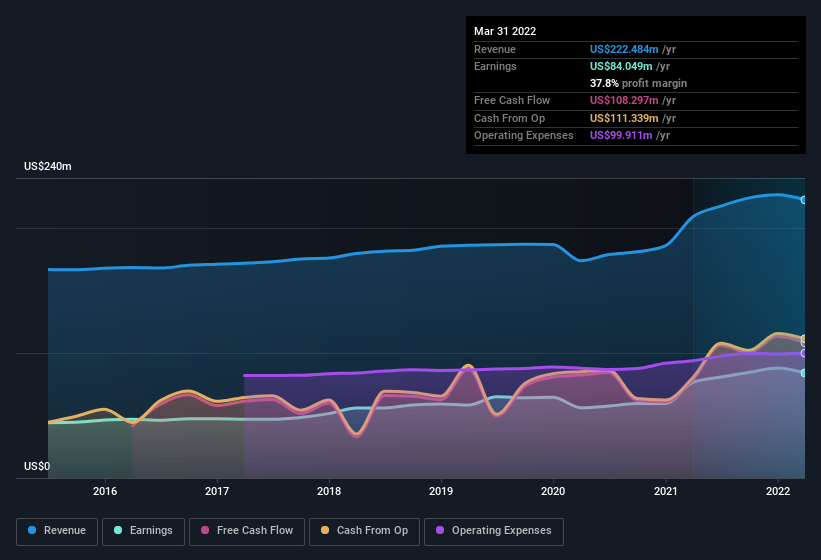

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Community Trust Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Community Trust Bancorp maintained stable EBIT margins over the last year, all while growing revenue 6.4% to US$222m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Community Trust Bancorp's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Community Trust Bancorp Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last year insider at Community Trust Bancorp were both selling and buying shares; but happily, as a group they spent US$144k more on stock, than they netted from selling it. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by Independent Chairman & Lead Director M. Parrish for US$300k worth of shares, at about US$41.50 per share.

Along with the insider buying, another encouraging sign for Community Trust Bancorp is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$37m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 4.9% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Mark Gooch, is paid less than the median for similar sized companies. For companies with market capitalizations between US$400m and US$1.6b, like Community Trust Bancorp, the median CEO pay is around US$3.8m.

The CEO of Community Trust Bancorp only received US$682k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Community Trust Bancorp Worth Keeping An Eye On?

One positive for Community Trust Bancorp is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Community Trust Bancorp that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Community Trust Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.