Here's Why I Think Crocs (NASDAQ:CROX) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Crocs (NASDAQ:CROX). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Crocs

Crocs's Improving Profits

Over the last three years, Crocs has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Crocs's EPS shot from US$1.70 to US$4.64, over the last year. Year on year growth of 174% is certainly a sight to behold.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Crocs is growing revenues, and EBIT margins improved by 7.6 percentage points to 18%, over the last year. That's great to see, on both counts.

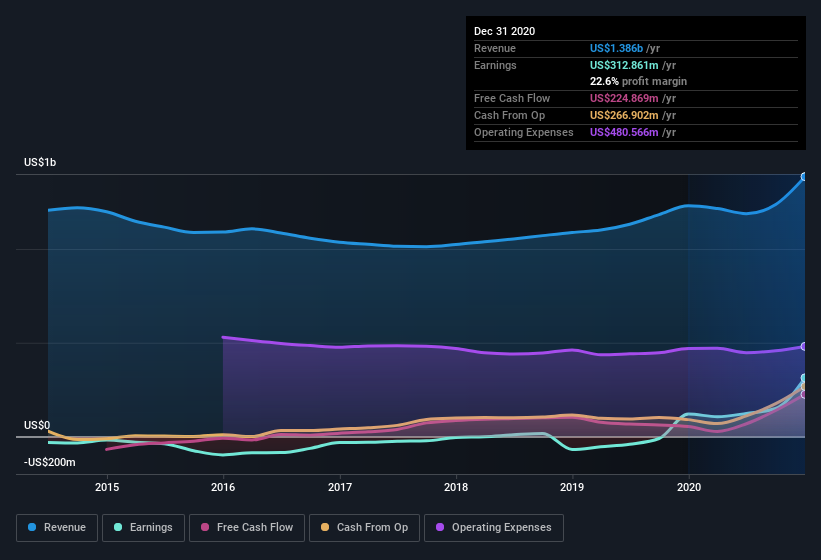

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Crocs's future profits.

Are Crocs Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$5.6b company like Crocs. But we are reassured by the fact they have invested in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$104m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Is Crocs Worth Keeping An Eye On?

Crocs's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Crocs for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Crocs you should be aware of, and 1 of them is potentially serious.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.