Here's Why We Think CSP (NASDAQ:CSPI) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like CSP (NASDAQ:CSPI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for CSP

How Fast Is CSP Growing Its Earnings Per Share?

In the last three years CSP's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, CSP's EPS shot from US$0.42 to US$1.03, over the last year. It's not often a company can achieve year-on-year growth of 146%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that CSP is growing revenues, and EBIT margins improved by 3.0 percentage points to 2.9%, over the last year. Both of which are great metrics to check off for potential growth.

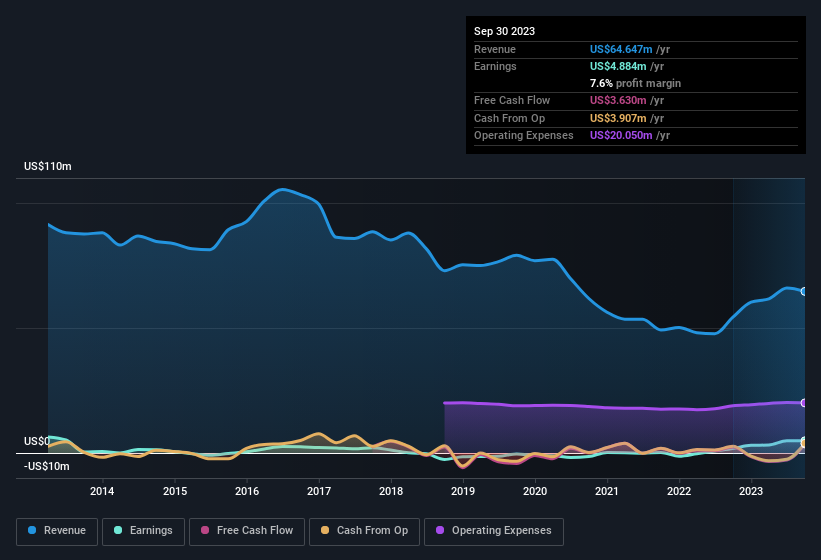

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since CSP is no giant, with a market capitalisation of US$136m, you should definitely check its cash and debt before getting too excited about its prospects.

Are CSP Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One gleaming positive for CSP, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one big hit, company insider Joseph Nerges paid US$330k, for shares at an average price of US$18.38 per share. It doesn't get much better than that, in terms of large investments from insiders.

The good news, alongside the insider buying, for CSP bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$42m worth of its stock. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 31% of the shares on issue for the business, an appreciable amount considering the market cap.

Does CSP Deserve A Spot On Your Watchlist?

CSP's earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe CSP deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with CSP , and understanding this should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, CSP isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.