Here's Why I Think Guaranty Bancshares (NASDAQ:GNTY) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Guaranty Bancshares (NASDAQ:GNTY). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Guaranty Bancshares

How Quickly Is Guaranty Bancshares Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Guaranty Bancshares's EPS has grown 35% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

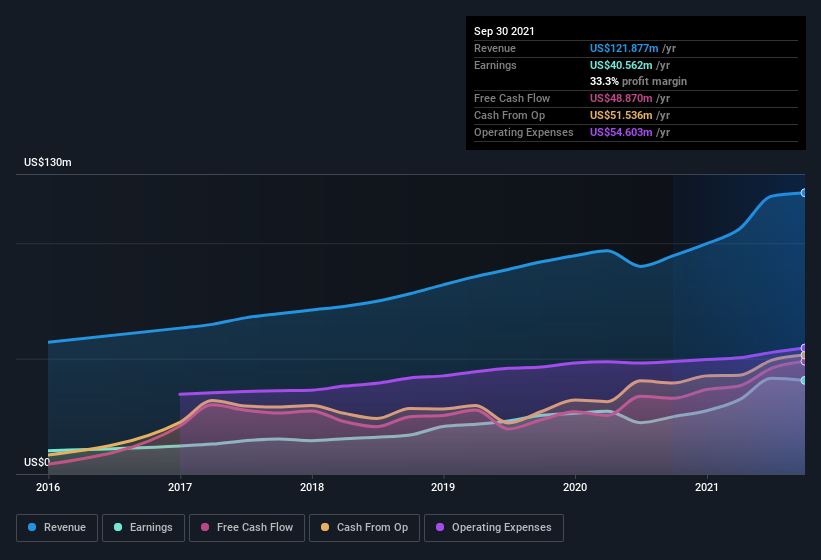

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Guaranty Bancshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Guaranty Bancshares's EBIT margins were flat over the last year, revenue grew by a solid 29% to US$122m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Guaranty Bancshares.

Are Guaranty Bancshares Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Guaranty Bancshares were both selling and buying shares; but happily, as a group they spent US$142k more on stock, than they netted from selling it. On balance, that's a good sign. We also note that it was the Independent Director, James Bunch, who made the biggest single acquisition, paying US$180k for shares at about US$31.12 each.

Along with the insider buying, another encouraging sign for Guaranty Bancshares is that insiders, as a group, have a considerable shareholding. With a whopping US$92m worth of shares as a group, insiders have plenty riding on the company's success. That holding amounts to 19% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Ty Abston, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Guaranty Bancshares with market caps between US$200m and US$800m is about US$1.7m.

Guaranty Bancshares offered total compensation worth US$1.1m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Guaranty Bancshares To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Guaranty Bancshares's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. Still, you should learn about the 3 warning signs we've spotted with Guaranty Bancshares (including 1 which is a bit unpleasant) .

The good news is that Guaranty Bancshares is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.