Here's Why We Think James Hardie Industries (ASX:JHX) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in James Hardie Industries (ASX:JHX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for James Hardie Industries

James Hardie Industries' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that James Hardie Industries has grown EPS by 47% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

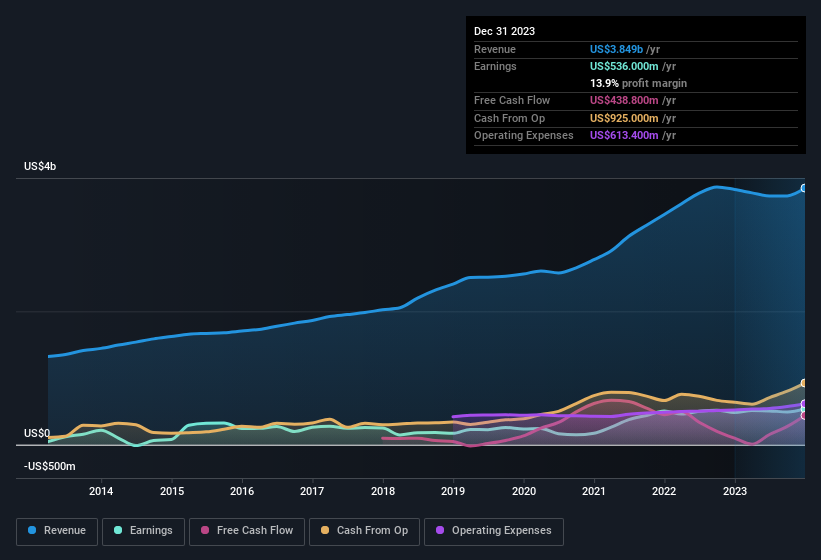

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for James Hardie Industries as both revenue and EBIT margins remained have been flat over the past year. That's not a major concern but nor does it point to the long term growth we like to see.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for James Hardie Industries?

Are James Hardie Industries Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a AU$27b company like James Hardie Industries. But we do take comfort from the fact that they are investors in the company. As a matter of fact, their holding is valued at US$25m. This considerable investment should help drive long-term value in the business. Despite being just 0.09% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add James Hardie Industries To Your Watchlist?

James Hardie Industries' earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, James Hardie Industries is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Of course, just because James Hardie Industries is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Australian companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.