Here's Why We Think MP Materials (NYSE:MP) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in MP Materials (NYSE:MP). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide MP Materials with the means to add long-term value to shareholders.

View our latest analysis for MP Materials

MP Materials' Improving Profits

Over the last three years, MP Materials has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. It's good to see that MP Materials' EPS has grown from US$1.17 to US$1.36 over twelve months. This amounts to a 16% gain; a figure that shareholders will be pleased to see.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While MP Materials did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

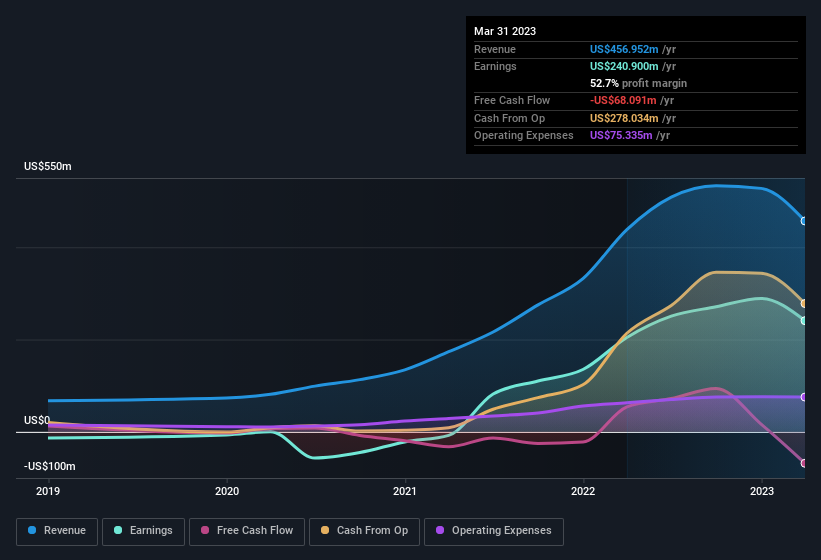

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of MP Materials' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are MP Materials Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One gleaming positive for MP Materials, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one big hit, Chief Operating Officer Michael Rosenthal paid US$382k, for shares at an average price of US$21.63 per share. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

On top of the insider buying, it's good to see that MP Materials insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$507m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because MP Materials' CEO, James Litinsky, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between US$2.0b and US$6.4b, like MP Materials, the median CEO pay is around US$6.7m.

The MP Materials CEO received total compensation of just US$1.6m in the year to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is MP Materials Worth Keeping An Eye On?

As previously touched on, MP Materials is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. We don't want to rain on the parade too much, but we did also find 1 warning sign for MP Materials that you need to be mindful of.

The good news is that MP Materials is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here