Here's Why I Think Mueller Industries (NYSE:MLI) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Mueller Industries (NYSE:MLI). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Mueller Industries

Mueller Industries's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Mueller Industries's EPS went from US$3.04 to US$9.91 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

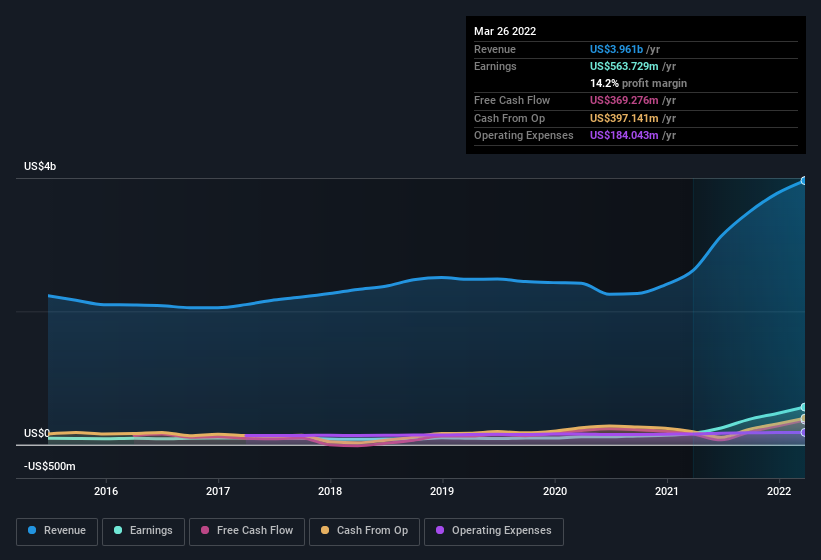

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Mueller Industries shareholders can take confidence from the fact that EBIT margins are up from 11% to 18%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Mueller Industries Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

For the sake of balance, I do note Mueller Industries insiders sold -US$374k worth of shares last year. But this is outweighed by the Independent Director Gary Gladstein who spent US$544k buying shares, at an average price of around around US$47.71.

On top of the insider buying, it's good to see that Mueller Industries insiders have a valuable investment in the business. With a whopping US$88m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Should You Add Mueller Industries To Your Watchlist?

Mueller Industries's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Mueller Industries deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Mueller Industries , and understanding it should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Mueller Industries, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.