Here's Why I Think Plumas Bancorp (NASDAQ:PLBC) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Plumas Bancorp (NASDAQ:PLBC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Plumas Bancorp

How Fast Is Plumas Bancorp Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Plumas Bancorp managed to grow EPS by 9.5% per year, over three years. That's a good rate of growth, if it can be sustained.

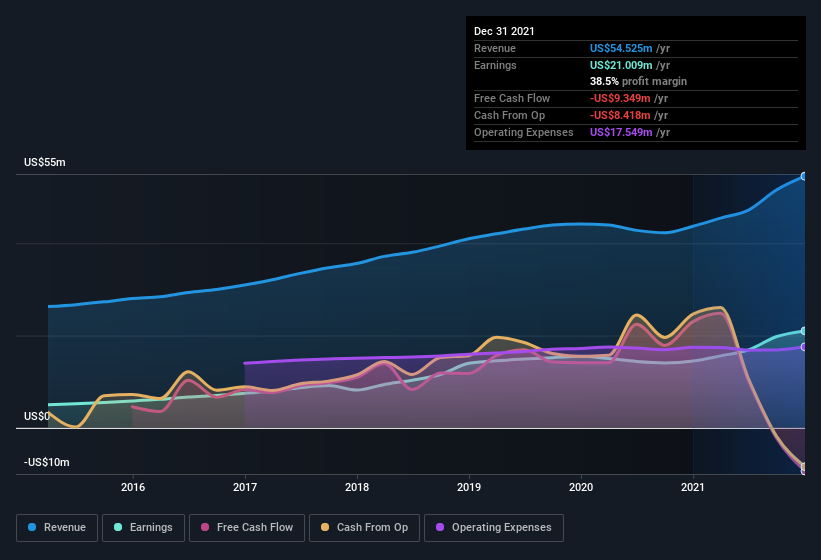

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Plumas Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Plumas Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 25% to US$55m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Plumas Bancorp is no giant, with a market capitalization of US$223m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Plumas Bancorp Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Plumas Bancorp were both selling and buying shares; but happily, as a group they spent US$66k more on stock, than they netted from selling it. On balance, that's a good sign. It is also worth noting that it was Independent Director Heidi Gansert who made the biggest single purchase, worth US$45k, paying US$36.25 per share.

On top of the insider buying, it's good to see that Plumas Bancorp insiders have a valuable investment in the business. Indeed, they hold US$18m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 8.1% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Andy Ryback, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Plumas Bancorp with market caps between US$100m and US$400m is about US$1.1m.

The Plumas Bancorp CEO received total compensation of just US$438k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Plumas Bancorp Deserve A Spot On Your Watchlist?

One important encouraging feature of Plumas Bancorp is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Plumas Bancorp (at least 1 which is concerning) , and understanding them should be part of your investment process.

As a growth investor I do like to see insider buying. But Plumas Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.