Here's Why We Think Seagate Technology (NASDAQ:STX) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Seagate Technology (NASDAQ:STX). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Seagate Technology

How Fast Is Seagate Technology Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Who among us would not applaud Seagate Technology's stratospheric annual EPS growth of 41%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

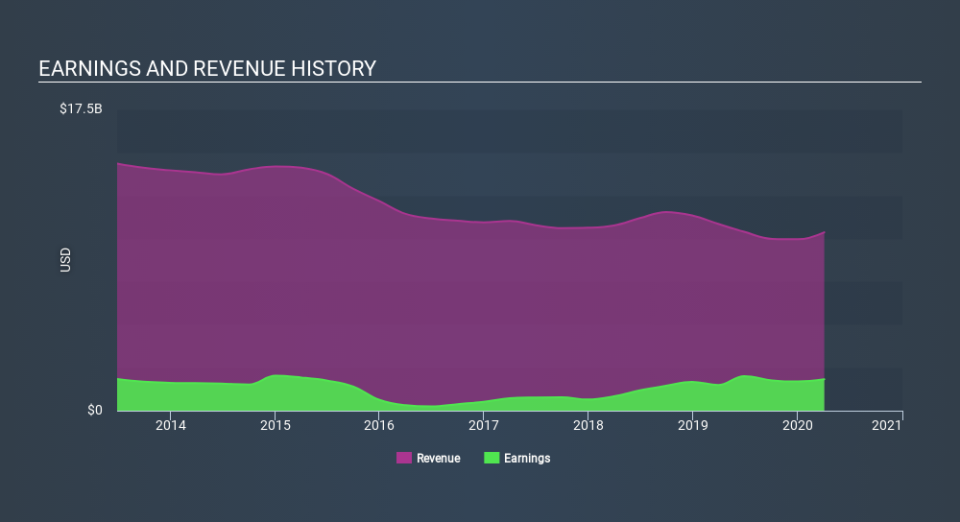

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, revenue is down and so are margins. That will not make it easy to grow profits, to say the least.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Seagate Technology EPS 100% free.

Are Seagate Technology Insiders Aligned With All Shareholders?

Since Seagate Technology has a market capitalization of US$13b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Given insiders own a small fortune of shares, currently valued at US$57m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Seagate Technology, with market caps over US$8.0b, is about US$12m.

Seagate Technology offered total compensation worth US$10m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Seagate Technology To Your Watchlist?

Seagate Technology's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think Seagate Technology is worth considering carefully. What about risks? Every company has them, and we've spotted 2 warning signs for Seagate Technology you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.