Here's Why I Think Southside Bancshares (NASDAQ:SBSI) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Southside Bancshares (NASDAQ:SBSI), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Southside Bancshares

Southside Bancshares's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Southside Bancshares has managed to grow EPS by 24% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

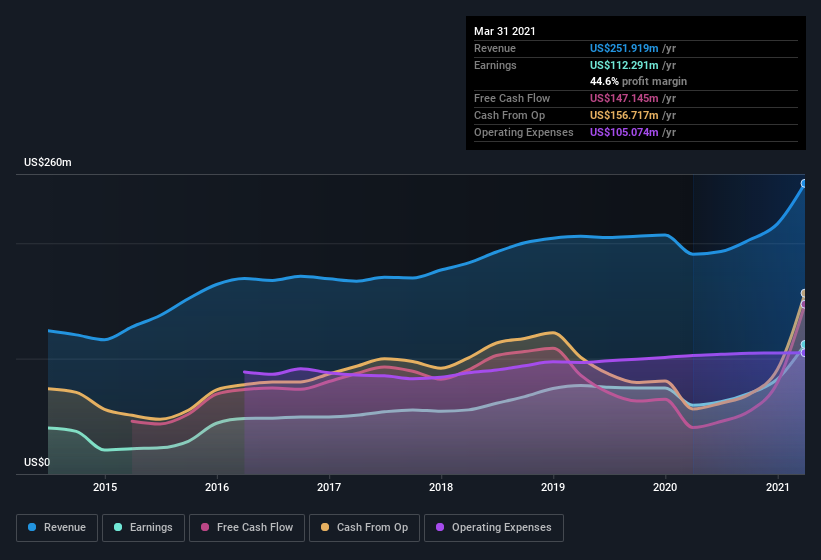

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Southside Bancshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Southside Bancshares maintained stable EBIT margins over the last year, all while growing revenue 32% to US$252m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Southside Bancshares?

Are Southside Bancshares Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Southside Bancshares insiders have a significant amount of capital invested in the stock. With a whopping US$63m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations between US$1.0b and US$3.2b, like Southside Bancshares, the median CEO pay is around US$3.7m.

The Southside Bancshares CEO received US$2.7m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Southside Bancshares Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Southside Bancshares's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Each to their own, but I think all this makes Southside Bancshares look rather interesting indeed. We don't want to rain on the parade too much, but we did also find 3 warning signs for Southside Bancshares (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.