Here's Why Verisk (VRSK) Should be Retained in Your Portfolio

Verisk Analytics, Inc. VRSK thrives on innovative products like FairCheck for insurers, Xactimate tools for efficient property estimation and XactXpert for automated claim reviews. Strategic collaborations, such as the NFPA and OneShield collaborations, drive growth, while acquisitions, such as SV Krug, strengthen global data capabilities. Verisk's diverse initiatives revolutionize insurance processes and reinforce its commitment to data excellence.

Factors in Favor

Verisk is gaining from new product offerings, which expand the brand’s footprints. The company has introduced FairCheck, aiding insurers in evaluating and mitigating potential discriminatory outcomes in personal lines models and addressing regulatory changes. Xactimate Time & Materials simplifies cost tracking for property estimation, offering real-time updates. XactXpert, a rules engine in Verisk’s Xactimate, automates property claim estimate reviews, thus reducing processing time from days to minutes. These innovative solutions enhance efficiency and transparency in insurance, construction and restoration processes.

Strategic collaborations are a stepping stone in Verisk’s growth strategy. The company has expanded collaboration with NFPA, extending wildfire risk data to 12 western U.S. states. Pearl Holding Group leverages Verisk’s LightSpeed for agent channel control and cost savings in nonstandard auto insurance quotes. OneShield’s integration with Verisk's ISO ERC™ is a strategic move, which enhances insurance solutions, lowers costs, reduces risks and facilitates rapid market entry for insurers.

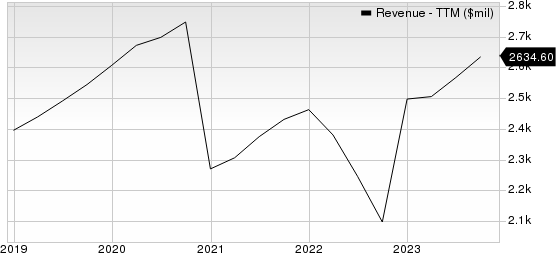

Verisk Analytics, Inc. Revenue (TTM)

Verisk Analytics, Inc. revenue-ttm | Verisk Analytics, Inc. Quote

Verisk prioritizes acquisitions in its growth strategy, consistently investing globally to bolster data and analytics capabilities. Planitar Inc. and Verisk have introduced iGUIDE Instant Sketch, revolutionizing insurance claims processing with automated floor plan creation. This collaboration enhances efficiency and supports comprehensive claims processing for insurance adjusters. Verisk's recent acquisition of SV Krug in Europe further strengthens its claims and casualty offerings, aligning with the company's commitment to enhancing global data and analytics capabilities.

Verisk's current ratio at the end of third-quarter 2023 was pegged at 1.18, higher than the current ratio of 1.07 reported at the end of the previous quarter and 0.46 at the end of the year-ago quarter. Increasing current ratio is favorable as it indicates that the company is not likely to have problems meeting its short-term debt obligations.

Risk

Verisk's business model heavily relies on vast data volumes, exposing it to operational risks such as security breaches in facilities, networks and databases. These incidents could result in a loss of credibility or customers. The company's dependence on external data sources may also lead to contractual and pricing issues with suppliers, some of whom may be competitors. Additionally, the risk of data theft and misuse by third-party contractors poses a threat to business continuity and the overall existence of the company.

VRSK currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector:

Gartner IT: The Zacks Consensus Estimate of Gartner’s 2023 revenues indicates 7.9% growth from the year-ago figure while earnings are expected to decline 1.9%. The company has beaten the consensus estimate in all four quarters, with an average surprise of 34.4%.

IT sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

FTI Consulting FCN: The Zacks Consensus Estimate of FCN’s 2023 revenues indicates 12.1% growth from the year-ago figure while earnings are expected to grow 3.4%. The company has beaten the consensus estimate in three of the four quarters and missed on one instance, the average surprise being 8.5%.

FCN currently has a Zacks Rank #2 (Buy).

Broadridge Financial Solutions BR: The Zacks Consensus Estimate of Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago figure while earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR presently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report