Here's Why We're Wary Of Buying TGS-NOPEC Geophysical Company ASA's (OB:TGS) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see TGS-NOPEC Geophysical Company ASA (OB:TGS) is about to trade ex-dividend in the next 3 days. Investors can purchase shares before the 1st of August in order to be eligible for this dividend, which will be paid on the 15th of August.

TGS-NOPEC Geophysical's next dividend payment will be US$2.34 per share, which looks like a nice increase on last year, when the company distributed a total of US$1.08 to shareholders. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for TGS-NOPEC Geophysical

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. TGS-NOPEC Geophysical paid out more than half (67%) of its earnings last year, which is a regular payout ratio for most companies. A useful secondary check can be to evaluate whether TGS-NOPEC Geophysical generated enough free cash flow to afford its dividend. It paid out 76% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. TGS-NOPEC Geophysical's earnings per share have fallen at approximately 13% a year over the previous 5 years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

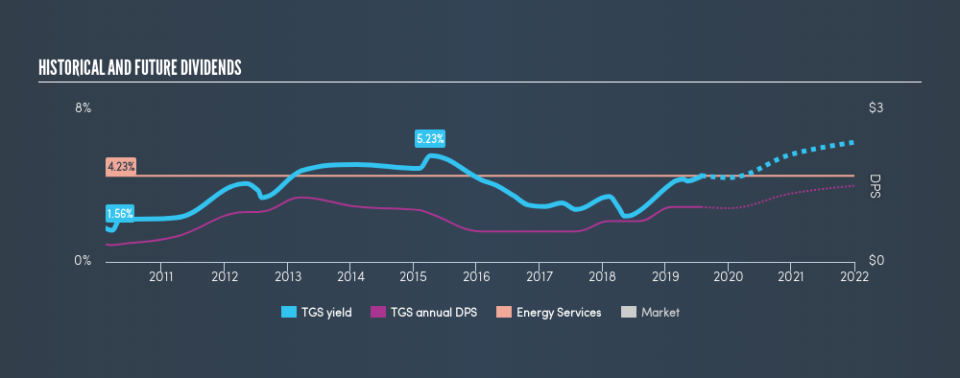

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 9 years ago, TGS-NOPEC Geophysical has lifted its dividend by approximately 14% a year on average. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

Final Takeaway

Has TGS-NOPEC Geophysical got what it takes to maintain its dividend payments? It's never good to see earnings per share shrinking, but at least the dividend payout ratios appear reasonable. We're aware though that if earnings continue to decline, the dividend could be at risk. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Curious what other investors think of TGS-NOPEC Geophysical? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow .

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.