Here's Why It is Worth Investing in RBC Bearings (RBC) Stock

RBC Bearings Incorporated RBC is well-poised for growth, courtesy of strength across its segments, acquisitions and a sound capital deployment strategy.

Let’s delve into the factors that make this Zacks Rank #2 (Buy) company a smart investment choice at the moment.

Business Strength: RBC’s Aerospace/Defense segment is benefiting from the increasing demand in the commercial original equipment manufacturer, aftermarket, aerospace and marine end markets. Strength in the aggregate and cement, food and beverage, mining and metals and general industrial end markets is supporting sales from the Industrial segment.

Acquisition Benefits: RBC Bearings intends to strengthen and expand its businesses through acquisitions. The company acquired Carson City, NV based precision bearings manufacturer, Specline, Inc. in August 2023. Specline’s unique bearing and manufacturing processes expand RBC Bearings’ aerospace product offerings and boost the company’s production capacity.

Product Development Initiatives: The company’s product development initiatives and robust demand for large planes like the Airbus 737, 787, A320 and A330, are expected to drive growth in the quarters ahead. Additional volume increases, driven by RBC Bearings’ space initiatives, are also likely to be beneficial.

Rewards to Shareholders: The company’s measures to reward its shareholders through dividend payments and share buybacks are noteworthy. The company repurchased shares worth $7.7 million and distributed preferred dividends worth $22.9 million in fiscal 2023 (ended March 2023). In the first three months of 2024 (ended Jul 01, 2023), the company paid dividends of $6.8 million, up 13.3% year over year.

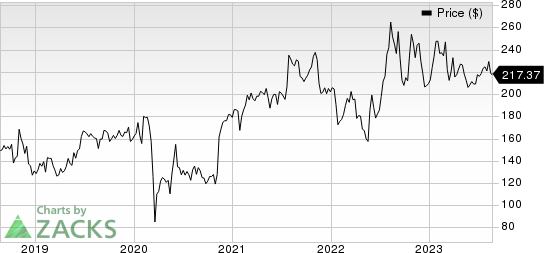

RBC Bearings Incorporated Price

RBC Bearings Incorporated price | RBC Bearings Incorporated Quote

Northbound Estimate Revisions: In the past 60 days, the Zacks Consensus Estimate for fiscal 2024 (ending March 2024) earnings has been revised 4.2% upward.

Other Stocks to Consider

Some other top-ranked companies from the Industrial Products sector are discussed below:

Caterpillar Inc. CAT presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

CAT’s earnings surprise in the last four quarters was 18.5%, on average. In the past 60 days, estimates for Caterpillar’s earnings have increased 10.3% for 2023. The stock has gained 39.1% in the past year.

A. O. Smith Corp. AOS presently carries a Zacks Rank of 2. AOS’ earnings surprise in the last four quarters was 10.5%, on average.

In the past 60 days, estimates for A. O. Smith’s earnings have increased 2.9% for 2023. The stock has gained 13.9% in the past year.

Alamo Group Inc. ALG presently carries a Zacks Rank of 2. ALG’s earnings surprise in the last four quarters was 13%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 1.1%. The stock has gained 26.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

RBC Bearings Incorporated (RBC) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report