Hershey Co (HSY) Reports Modest Sales Growth Amid Rising Costs

Consolidated net sales: Increased by 7.2% to $11.165 billion in 2023.

Q4 net sales: Slight increase of 0.2% to $2.657 billion.

Reported net income: Grew to $1.861 billion for the full year, up 13.8%.

Q4 reported net income: Decreased by 11.5% to $349 million.

Adjusted EPS: Remained flat at $2.02 for Q4, but increased by 12.6% to $9.59 for the full year.

2024 Outlook: Expects 2-3% net sales growth and flat earnings per share.

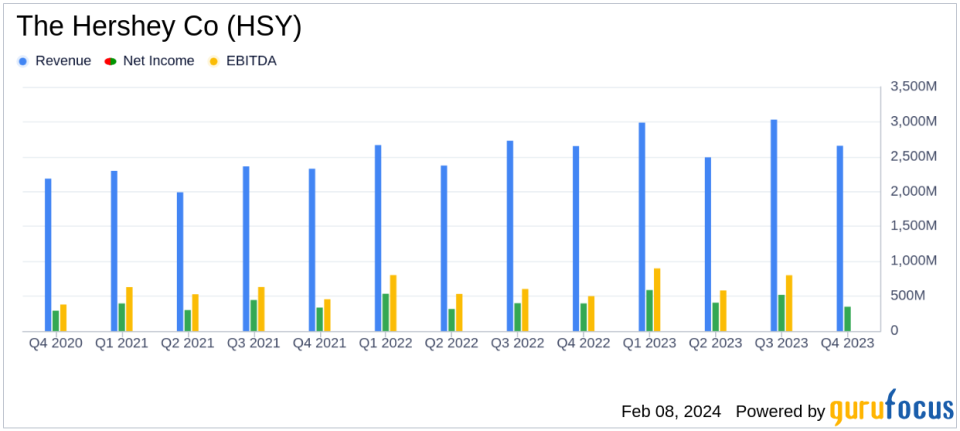

On February 8, 2024, The Hershey Co (NYSE:HSY) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a dominant force in the U.S. confectionery market with a portfolio of over 100 brands, reported a modest increase in net sales for the fourth quarter, while full-year sales showed a stronger performance.

Company Overview

Hershey, with a market capitalization of around $25 billion, controls approximately 45% of the U.S. chocolate market. The company's expansive brand portfolio includes popular names like Reese's, Kit Kat, and Ice Breakers. While Hershey's presence is global, with products sold in roughly 80 countries, the majority of its sales are generated domestically. Recent strategic acquisitions such as Amplify Snack Brands, Pirate Brands, and Dot's Pretzels have broadened Hershey's reach beyond traditional confectionery.

Financial Performance and Challenges

The company's performance in 2023 reflects resilience in the face of a dynamic market environment. Full-year consolidated net sales rose by 7.2% to $11.165 billion, with organic, constant currency net sales also up by 7.0%. However, the fourth quarter saw a slight 0.2% increase in net sales to $2.657 billion, with a marginal organic, constant currency net sales decrease of 0.1%. This performance is significant as it demonstrates Hershey's ability to maintain growth despite market challenges, such as historic cocoa prices, which are expected to constrain earnings growth in the coming year.

Reported net income for the full year was a highlight, increasing by 13.8% to $1.861 billion, or $9.06 per share-diluted. However, the fourth quarter reported net income saw an 11.5% decrease to $349 million, or $1.70 per share-diluted. Adjusted earnings per share-diluted remained flat at $2.02 for the fourth quarter, while the full year saw a 12.6% increase to $9.59. These financial achievements underscore Hershey's ability to navigate cost pressures and maintain profitability, which is crucial in the competitive Consumer Packaged Goods industry.

Key Financial Metrics and Outlook

Important metrics from the financial statements include a reported gross margin decrease of 90 basis points to 42.3% in the fourth quarter, while the adjusted gross margin increased by 50 basis points to 44.2%. Selling, marketing, and administrative expenses rose by 6.9% in the fourth quarter compared to the previous year, reflecting investments in capabilities and inflationary pressures.

For 2024, Hershey anticipates net sales growth of 2% to 3%, primarily driven by net price realization. However, reported and adjusted earnings per share are expected to be relatively flat due to higher cocoa and sugar costs, as well as one-time expenses related to the Q2 ERP implementation and planned incremental cost savings initiatives.

"We continue to operate in a dynamic environment, but we are encouraged by the resilience of seasonal traditions and the consumer response to innovation within our categories," said Michele Buck, The Hershey Company President and Chief Executive Officer. "We are elevating our focus on productivity and transformation to strengthen our business and deliver peer leading performance over the long-term."

The company's performance analysis reveals that while Hershey is facing cost headwinds, its strategic focus on marketing, innovation, and productivity is poised to sustain its market leadership. The planned cost savings initiatives are expected to generate ongoing savings of $300 million by 2026, with $100 million anticipated in 2024. However, these efforts will also incur pre-tax charges estimated between $200 million to $250 million, indicating a period of investment for future efficiency gains.

Value investors and potential GuruFocus.com members interested in The Hershey Co's detailed financial performance can access the full earnings report and gain deeper insights into the company's strategies and financial health.

Explore the complete 8-K earnings release (here) from The Hershey Co for further details.

This article first appeared on GuruFocus.