The Hershey Co's Dividend Analysis

Delving Into The Hershey Co's Dividend Dynamics

The Hershey Co (NYSE:HSY) recently announced a dividend of $1.19 per share, payable on 2023-12-15, with the ex-dividend date set for 2023-11-16. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into The Hershey Co's dividend performance and assess its sustainability.

What Does The Hershey Co Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

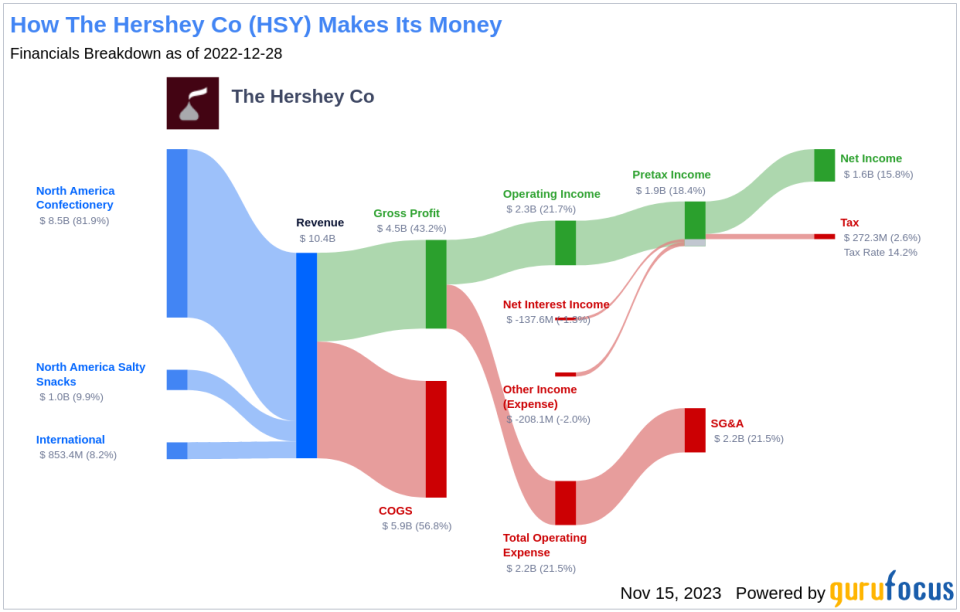

Hershey is a leading confectionery manufacturer in the U.S., boasting a market cap of around $25 billion and commanding approximately 45% of the domestic chocolate market, according to IRI data cited by the company. With a history spanning over 85 years, The Hershey Co's portfolio has grown to include over 100 brands such as Reese's, Kit Kat, Kisses, and Ice Breakers. Although the company's products are available in roughly 80 countries, a significant portion of its sales are generated within the U.S. In recent years, The Hershey Co has expanded into the snack segment, acquiring brands like Amplify Snack Brands, Pirate Brands, and Dot's Pretzels.

A Glimpse at The Hershey Co's Dividend History

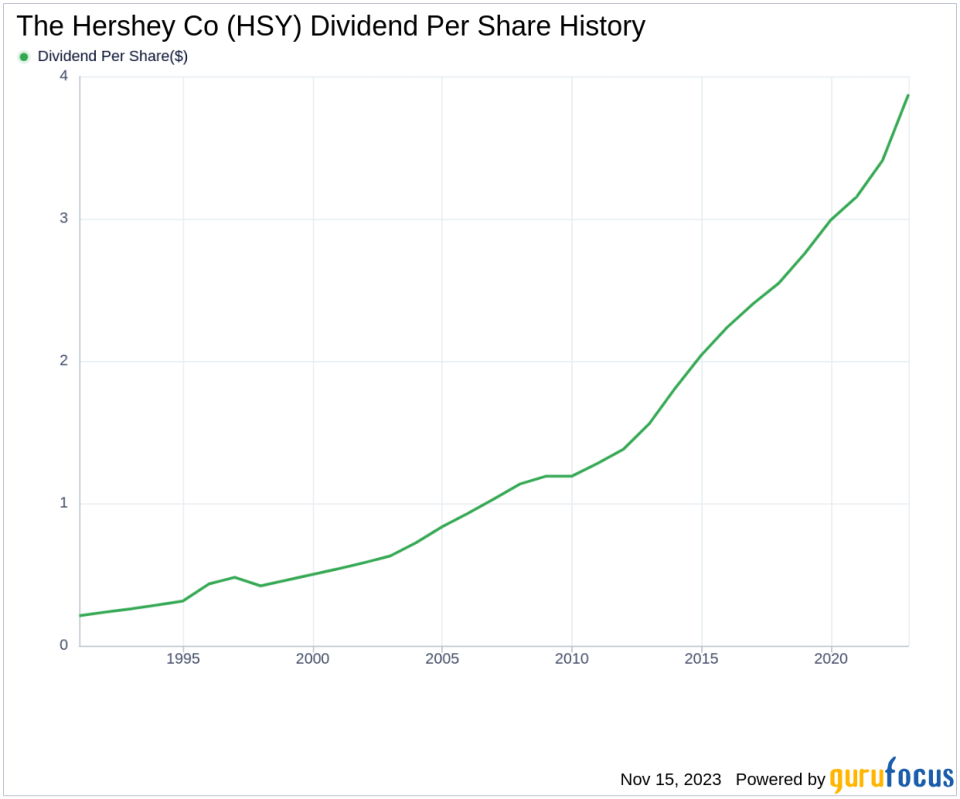

The Hershey Co has been a model of consistency in dividend payments, having done so since 1986. The company distributes dividends quarterly and has been increasing its dividend annually since 1997, earning it the prestigious title of a dividend aristocrata testament to its commitment to shareholder returns. The chart below illustrates the annual Dividends Per Share to help track The Hershey Co's historical trends.

Breaking Down The Hershey Co's Dividend Yield and Growth

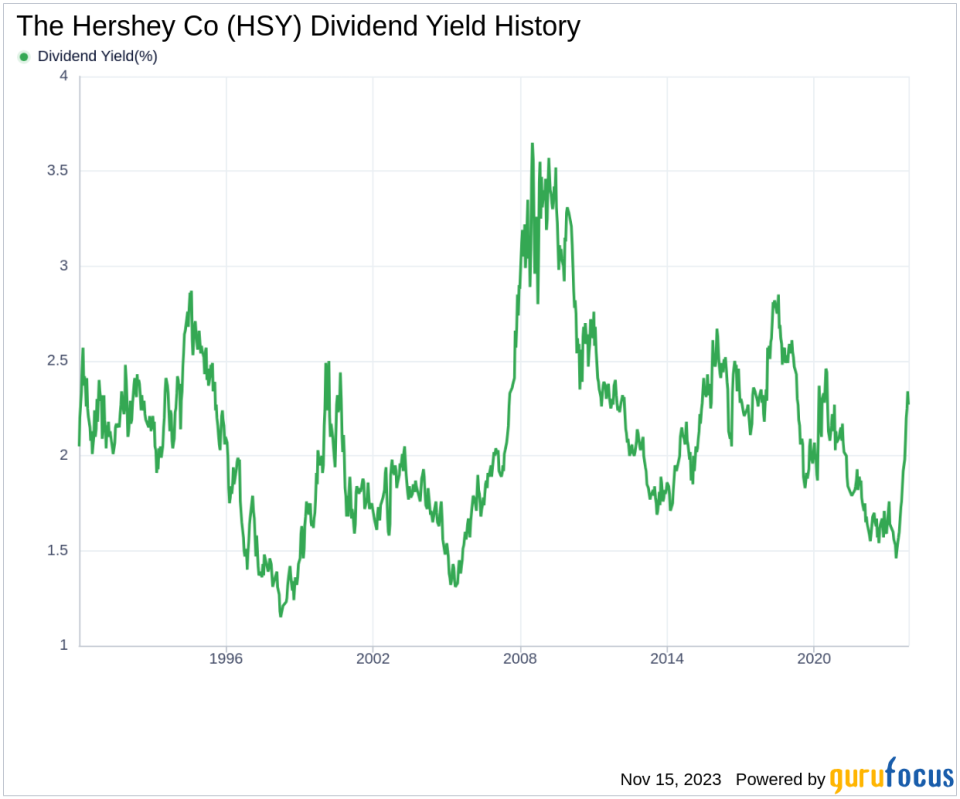

The Hershey Co currently sports a 12-month trailing dividend yield of 2.19% and a forward dividend yield of 2.43%. This indicates an anticipated increase in dividend payments over the next year. Over the past three years, The Hershey Co's dividend has grown by an average of 9.00% annually. This growth rate has slightly dipped to 8.30% over a five-year period, while the decade-long annual growth rate stands at 8.60%. The 5-year yield on cost for The Hershey Co stock is currently approximately 3.26%.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of a dividend is often gauged by the company's payout ratio. The Hershey Co's dividend payout ratio is 0.46 as of 2023-09-30, suggesting that nearly half of its earnings are returned to shareholders as dividends. The Hershey Co's profitability rank is 9 out of 10, indicating strong profitability compared to its peers. Consistent positive net income over the past decade further supports its financial health and dividend sustainability.

Growth Metrics: The Future Outlook

For dividend sustainability, growth metrics are crucial. The Hershey Co's growth rank is 9 out of 10, reflecting a promising growth trajectory. The company's revenue per share and 3-year revenue growth rate indicate a robust revenue model, with a 10.00% average annual increase that outperforms 61.9% of global competitors. The Hershey Co's 3-year EPS growth rate and 5-year EBITDA growth rate also outperform a majority of global competitors, at 12.60% and 12.70% respectively.

Next Steps

Considering The Hershey Co's impressive dividend track record, consistent growth in dividend payments, and a manageable payout ratio, the company's dividends appear to be on a sustainable path. Coupled with strong profitability and growth metrics, The Hershey Co stands out as a potentially attractive choice for income-focused investors. Those interested in further exploring high-dividend yield stocks can utilize the High Dividend Yield Screener available to GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.