Hershey (HSY) Benefits From Pricing Amid High SG&A Costs

The Hershey Company HSY has been successfully implementing a pricing strategy to offset inflation. Pricing led to a significant contribution of 7.7% to organic net sales growth in the second quarter. This pricing strategy had a particularly strong impact on the North America Confectionery and Salty Snacks segments.

HSY’s strength lies in its robust brand portfolio, featuring iconic names, such as Hershey's, Reese's, Hershey's Kisses, Jolly Rancher, Brookside, Sofit and Ice Breakers. These core brands continued to be strong in the second quarter of 2023 and did incredibly well, driven by substantial investments in advertising, in-store merchandising, programming and innovation.

Hershey is expecting a strong Halloween this year, knowing that customers are planning big displays. The company is well-placed to capitalize on the opportunity through effective marketing strategies.

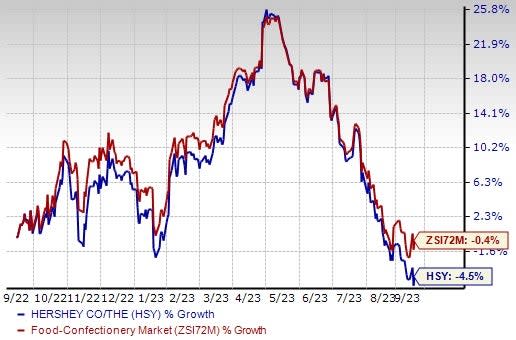

Image Source: Zacks Investment Research

Acquisition Strategy Bodes Well

The company has been actively pursuing acquisitions to bolster its product portfolio and diversify its revenue streams. This strategy was underscored in April 2023 when Hershey announced the acquisition of two production facilities from Weaver Popcorn Manufacturing.

This move aligns with Hershey's ongoing efforts to expand its presence in the popcorn production and co-packing sector. The movement not only supports continued growth of the SkinnyPop brand through supply-chain expansion but also solidifies Hershey's position in the thriving popcorn market.

The company's acquisition strategy is complemented by its continuous focus on strengthening production capabilities. A noteworthy initiative in this regard is the construction of a chocolate-making facility in Hershey, PA. This facility is expected to increase its production capacity by 5% in 2023, showcasing Hershey's dedication to optimizing its network for improved output, profit margins, utilization rates and service levels.

Wrapping Up

HSY has been grappling with higher selling, marketing and administrative expenses for a while. In the second quarter of 2023, the company saw a year-over-year increase of 5.2% in these expenses, primarily driven by factors like wage and benefits inflation, and elevated investments in media, capabilities and technology.

However, efficient pricing and brand strength place Hershey well despite cost hurdles. Management envisions net sales growth of 8% for 2023. Adjusted EPS is envisioned to increase 11-12% to $9.46-$9.54 in 2023.

Shares of this Zacks Rank #3 (Hold) company have lost 4.5% over the past year compared with the industry’s decline of 0.4%.

Bet Your Bucks on These Hot Stocks

We have highlighted three better-ranked stocks, namely MGP Ingredients, Inc. MGPI, McCormick & Company MKC and Celsius Holdings CELH.

MGP Ingredients produces and markets ingredients and distillery products to the packaged goods industry. The company currently sports a Zacks Rank #1 (Strong Buy). It has an expected EPS growth rate of 11% for three-five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and EPS suggests growth of 5.8% and 10.4%, respectively, from the year-ago reported figures. MGPI has a trailing four-quarter earnings surprise of around 18%, on average.

McCormick, a manufacturer, marketer and distributor of spices, seasoning mixes and condiments, currently carries a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 7.5% for three-five years.

The Zacks Consensus Estimate for McCormick’s current financial-year sales and EPS suggests growth of 6.4% and 5.1%, respectively, from the year-ago reported figures. MKC has a trailing four-quarter earnings surprise of 4.2%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 168.8%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report