Hershey (HSY) On Track With Pricing Actions & Innovations

The Hershey Company HSY is undertaking strategic pricing initiatives to drive growth. The leading snacks company boosts a portfolio of solid brands courtesy of prudent buyouts and innovations. However, the company is not immune to the rising cost environment.

Let’s delve deeper.

Pricing Strategies Fuel Growth

Hershey has been undertaking strategic pricing initiatives to improve its performance. The trend continued in the fourth quarter of 2023, with net sales rising 0.2% and a 6.5-point increase in net prices. Moreover, robust pricing strategies protect the company’s margin performance. The adjusted gross margin came in at 44.2%, up 50 basis points (bps), on the back of net price realization and improvements in supply-chain productivity. Management expects year-over-year net sales growth of 2-3% for 2024, primarily driven by net price realization.

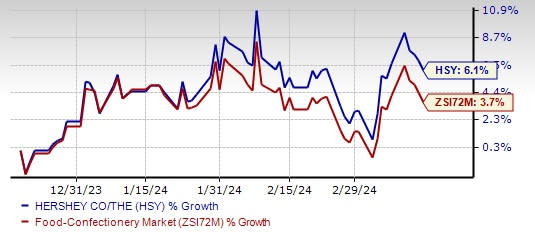

Image Source: Zacks Investment Research

Prudent Buyouts

Hershey is undertaking buyouts to augment portfolio strength and boost revenues. In December 2021, Hershey acquired Dot’s Pretzels LLC — the owner of Dot’s Homestyle Pretzels, a leading brand in the pretzel category. The addition of Dot’s Pretzels is a perfect match for Hershey’s growing salty snacking portfolio. Dot’s Pretzels remained strong in the fourth quarter of 2023, fueled by gains in distribution and velocity. The company also purchased Pretzels Inc. from an affiliate of Peak Rock Capital. The acquisition further expands Hershey’s snacking and production capabilities.

On Jun 25, 2021, Hershey concluded the acquisition of Lily's, a leading better-for-you (BFY) confectionery brand. The buyout is in tandem with Hershey’s focus on creating an impressive BFY confection portfolio as part of its multi-pronged, better-for-you snacking strategy.

Focus on Innovations

Hershey markets some of the world’s leading brands, which enjoy widespread consumer acceptance. The company is a global leader in sugar confectionery products, which is an attractive category as confectionery products are readily available, affordable and highly indulgent, thus making the industry almost recession-resistant. Hershey regularly brings innovation to its core brands to meet consumer demand and needs that are not addressed by its current portfolio.

In its last earnings call, management highlighted that it is impressed with the launch of its latest innovation, Reese’s Caramel. The company has innovation, distribution and merchandising activations in the pipeline for 2024, courtesy of a significant rise in capacity. Hershey's technology and capacity investments in the brand bode well.

Will Cost Hurdles be Countered?

Hershey has been grappling with higher selling, marketing and administrative expenses for a while. In the fourth quarter of 2023, the company’s selling, marketing and administrative expenses rose 6.9% year over year on increased levels of media, wage inflation and capability investments. Management expects gross profit dollars to decline low-single-digits and gross margin to contract by almost 200 bps in 2024. The downside was caused by high cocoa prices and elevated sugar costs, along with escalated labor inflation and unfavorable product mix. That being said, the company is on track with the Advancing Agility & Automation initiative to generate net run-rate savings and fuel investments.

Shares of the Zacks Rank #3 (Hold) company have gained 6.1% in the past three months compared with the industry’s 3.7% growth.

Solid Staple Picks

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal-year sales and earnings suggests growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 20.2% and 28.8%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2.6% on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 19.3% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report