Hershey (NYSE:HSY) Reports Sales Below Analyst Estimates In Q4 Earnings

Chocolate company Hershey (NYSE:HSY) fell short of analysts' expectations in Q4 FY2023, with revenue flat year on year at $2.66 billion. Its non-GAAP profit of $2.02 per share was flat year on year.

Is now the time to buy Hershey? Find out by accessing our full research report, it's free.

Hershey (HSY) Q4 FY2023 Highlights:

Revenue: $2.66 billion vs analyst estimates of $2.72 billion (2.4% miss)

EPS (non-GAAP): $2.02 vs analyst estimates of $1.96 (3.3% beat)

Guidance for 2024 EPS (non-GAAP): flat vs. 2023, implying roughly $9.60, below estimates of $9.81

Gross Margin (GAAP): 42.3%, down from 43.2% in the same quarter last year

Organic Revenue was down 0.1% year on year

Sales Volumes were down 6.6% year on year

Market Capitalization: $39.73 billion

"We continue to operate in a dynamic environment, but we are encouraged by the resilience of seasonal traditions and the consumer response to innovation within our categories," said Michele Buck, The Hershey Company President and Chief Executive Officer.

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE:HSY) is an iconic company known for its chocolate products.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Hershey is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

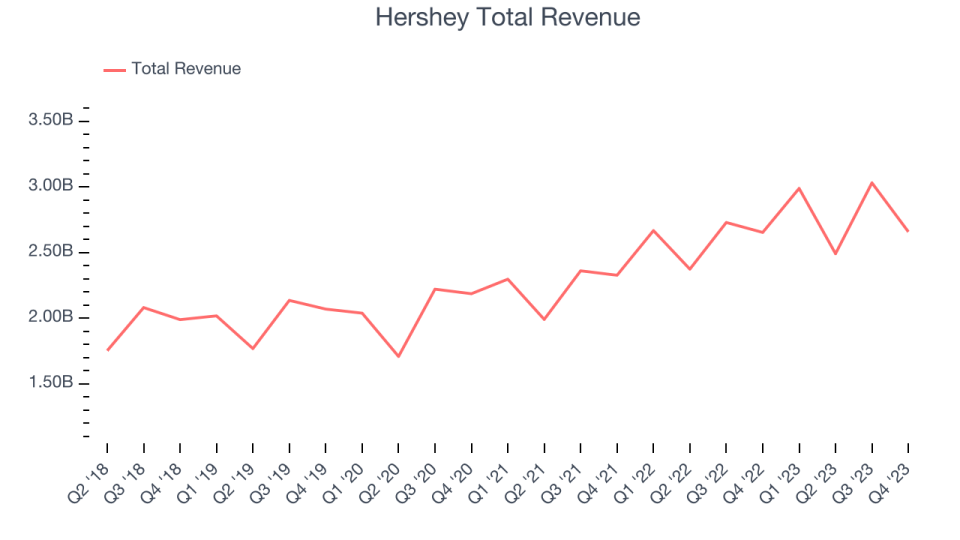

As you can see below, the company's annualized revenue growth rate of 11.1% over the last three years was decent despite selling a similar number of units each year. We'll explore what this means in the "Volume Growth" section.

This quarter, Hershey's revenue grew 0.2% year on year to $2.66 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.8% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

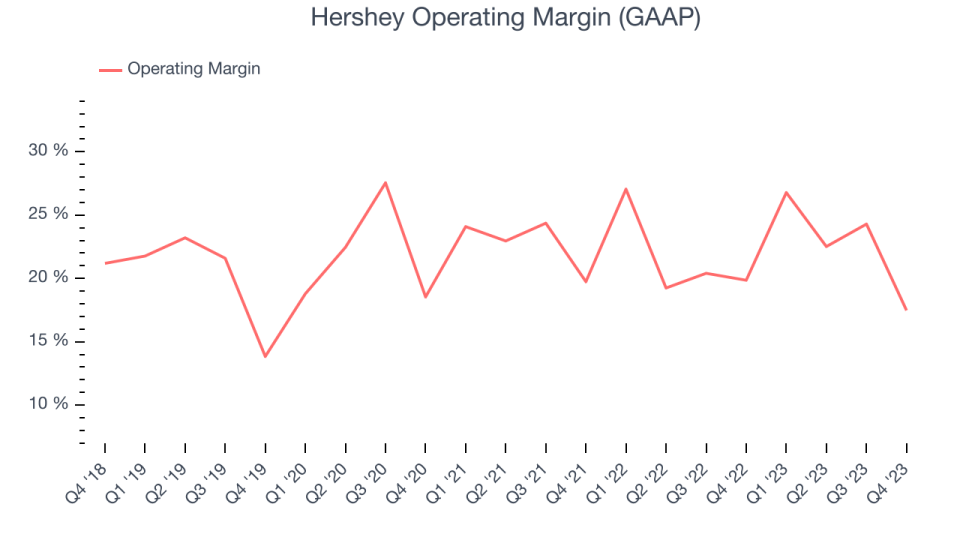

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Hershey generated an operating profit margin of 17.5%, down 2.4 percentage points year on year. Because Hershey's operating margin decreased more than its gross margin, we can infer the company was less efficient and increased spending in discretionary areas like corporate overhead and advertising.

Zooming out, Hershey has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 22.2%. On top of that, its margin has risen by 1.2 percentage points on average over the last year, showing the company is improving its fundamentals.

Key Takeaways from Hershey's Q4 Results

We struggled to find many strong positives in these results. Its organic revenue unfortunately missed analysts' expectations and its operating margin missed Wall Street's estimates. Guidance for 2024 EPS also calls for no growth, implying $9.60 per share and below Wall Street analysts' estimates. Overall, this was a mediocre quarter for Hershey. The stock is flat after reporting and currently trades at $193.27 per share.

Hershey may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.