Hershey Has a Sugar-Coated Valuation Even If Inflation Cools

The Hershey Co. (NYSE:HSY) is a stock worth holding for the long term despite not being overly attractive currently. The shares seems fairly priced at the moment considering my discounted cash flow model based on conservative projections.

Peak prices in the company's main raw materials, cocoa and sugar, are likely to compress margins and the growth trajectory in the next several quarters. Over the long term, however, its attractive dividends will reward patient investors.

Performance heavily impacted by raw materials

Hershey is one of the most famous U.S. confectionery manufacturers and sellers with an international presence. Its brand is its biggest asset, which could prove to be helpful in sustaining its margins. The stock has proven to be a sweet bet for investors despite the 30% pullback from its all-time high reached in May 2023.

HSY Data by GuruFocus

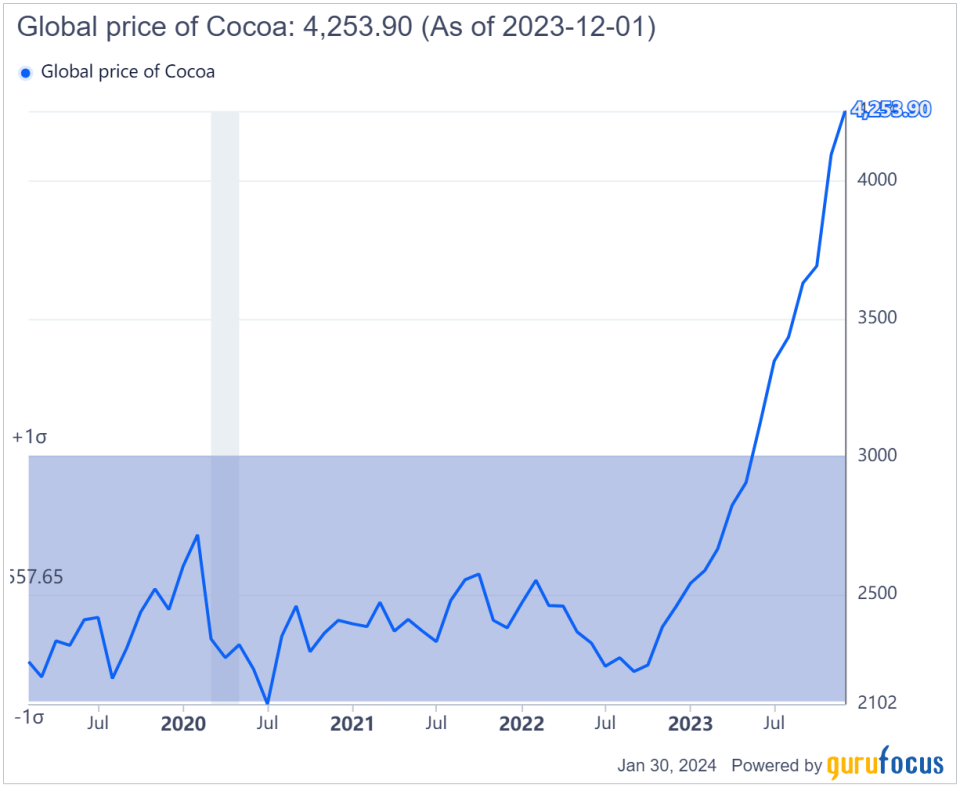

The pullback is not a coincidence; it corresponds to the price breakout of cocoa, which is currently trading at a whopping $4,253 per ton - 50% higher today than in May of last year and around a half-century price peak.

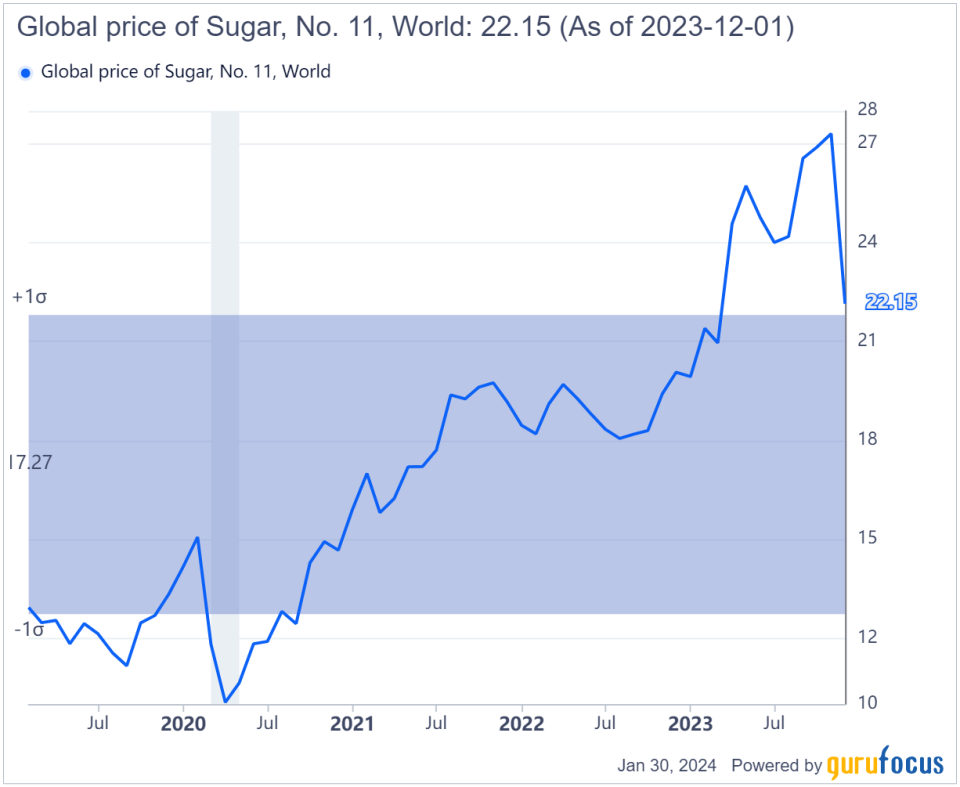

Another key ingredient for Hershey's sweet snacks is sugar. The picture is not any prettier with an almost consistent price increase since the summer of 2020, roughly doubling in price to around $22.

The cost increases of cocoa and sugar affect its competitors as well, so the overall sector is suffering from downward pressure on margins and it is rather unlikely to see the costs of those two raw materials going down. With the current freight cost increases due to the tense situation in the Red Sea and high energy costs, it is likely that sector growth will remain subdued. I have reflected these assumptions in my discounted cash flow model by using rather conservative projections.

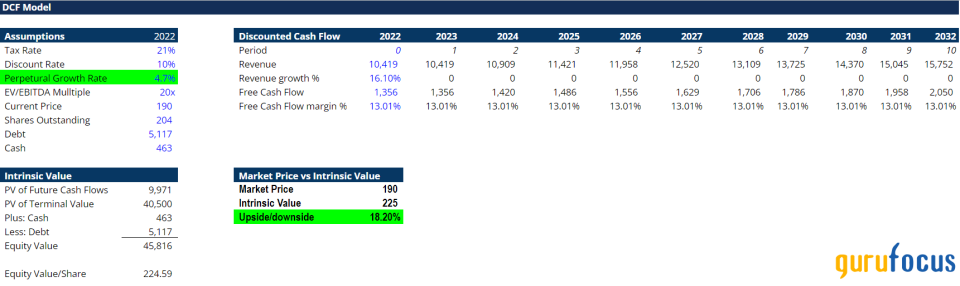

The DCF model shows the stock is trading at fair value

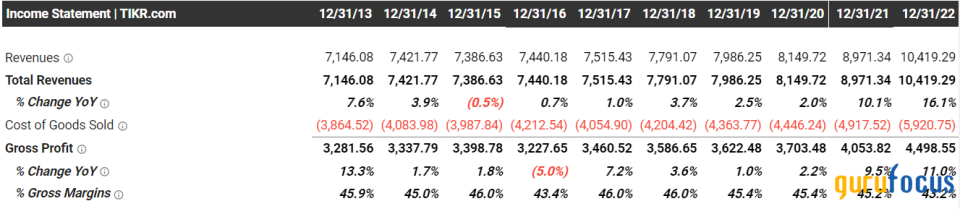

Hershey's financials have demonstrated consistent growth levels, albeit with some volatility in a 10-year range, from -0.5% to 16.1% in revenue growth.

The average revenue growth over that period is 4.70%. The average gross profit growth (revenue minus cost of goods sold) is also close at around 4.60% over the period. Up until now, the company has been able to preserve a gross profit margin of 43% to 46%.

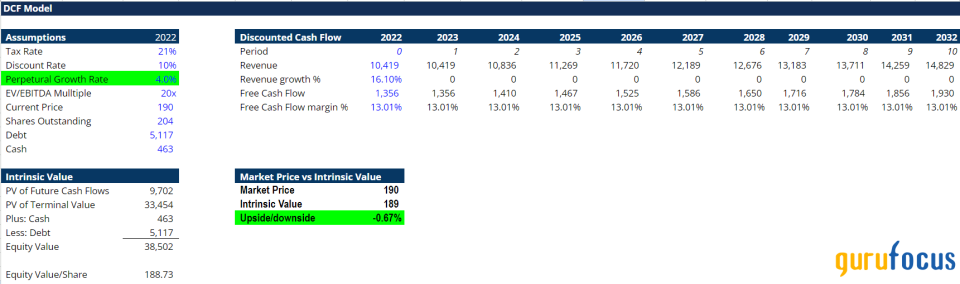

Interestingly, when I ran my DCF model, I found the markets were pricing the stock today with a 4% growth rate projection for revenue with constant free cash flow margins over the next 10 years (in line with the last 10 years' average of 13%) or, for instance, at a 20% reduction from the average revenue growth rate the company has grown at in the last 10 years.

In my view, it is a rational assumption from the markets to assume the company will grow slightly slower in the next decade than in the last given the high and rising prices of raw materials. This is the cautious case for the stock and, in light of this intrinsic valuation scenario, it is a hold.

What could invalidate my hold case

The stock could transform into a buy, ceteris paribus, if the rising prices of cocoa and sugar turn out to be only transitory and the growth prospects were to be readjusted to the last 10 years' average growth of 4.70%.

Indeed, in this upside case where cocoa and sugar prices cool and return to the mean, Hershey would be in a great position to benefit. With an untouched average growth, the intrinsic value of the stock would lie closer to $225 per share, or an 18.2% upside with a limited downside from the current stock price level of $190.

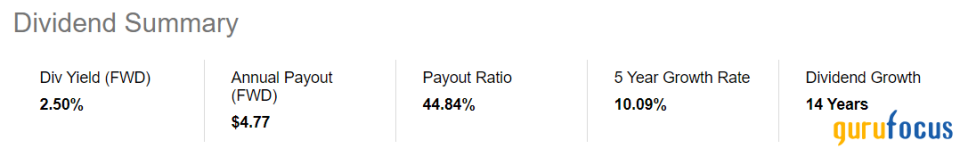

Owning the stock could prove to be an interesting play for the long term should demand cool with the impact of high interest rates and an economic slowdown, and should supply chains normalize in the next quarters. The current dividend yield of 2.5% could reward patient investors.

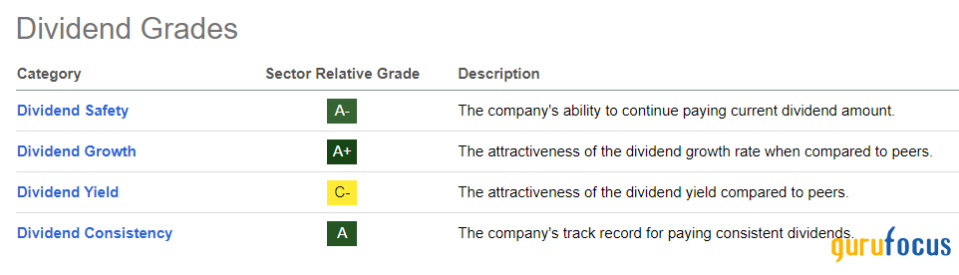

According to Seeking Alpha, the dividend grades further affirm the attractiveness of the stock as a dividend play.

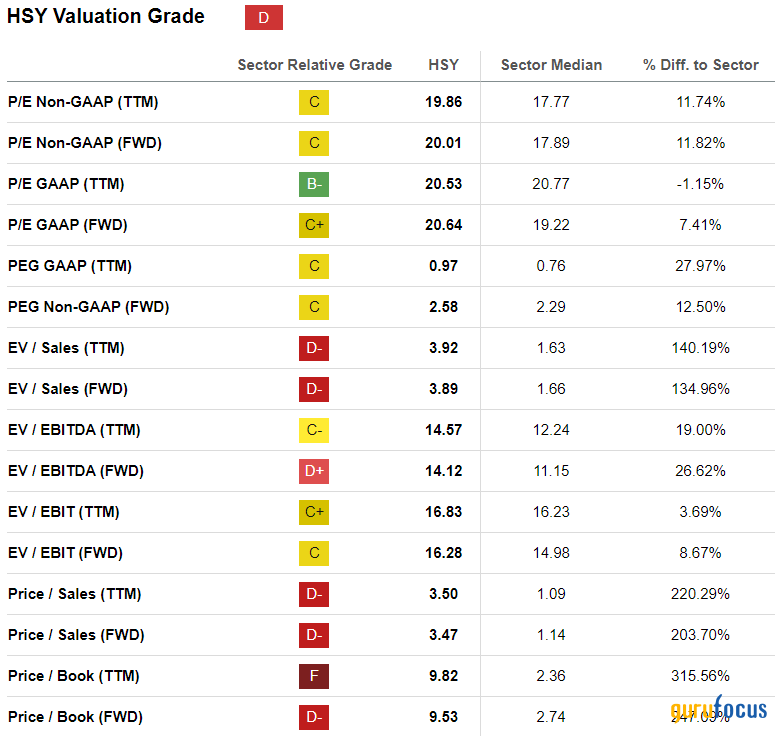

Despite a recognizable brand, solid financials, limited downside with possible (limited) upside and an attractive dividend narrative, my feelings remain mixed on the stock due to the current valuation metrics.

Hershey's unattractive valuation makes it a pass for me

One of the valuation metrics I like to look at as an investor is the price-book ratio. This metric reveals the ratio of the stock price in relation to the actual value of the business according to its balance sheet. It is essentially the ratio of the investor paying for what he would receive in case the company had to sell all its assets to cover liabilities and obligations. A shareholder owning a common share of a company is the last to receive any proceeds in case of a downturn leading to bankruptcy. Given that most companies are not on the brink of bankruptcy, a ratio of 1 or below is not vital when buying a stock. However any value under 3 is seen as a correct level for most seasoned portfolio managers. Hershey is trading at a price-book ratio above 9, which is three times higher than the sector median.

Additionally, the enterprise value-to-sales and EV-to-Ebitda ratios are also flashing orange lights, showing the stock is trading at a high to very high premium. It is understandable that for a good company with a recognizable brand and consistently performing finances, its stock would trade at a premium. However, I do not feel comfortable paying a high premium to initiate a long position in a stock where the bull case gives only 18% upside.

Bottom line

Hershey is a fantastic business with solid margins and an internationally recognizable brand. Although it is down 30% from its all-time high, the main reason to own the stock, in my view, is simply as a pure dividend play and eventually as a bet that inflation (of commodities) is transitory. However, based on the intrinsic value of the company from my DCF model and based on ots valuation relative to its sector, I am not persuaded the stock is an attractive one to open a new position in right now while cocoa and sugar price levels remain elevated and on a rising trend. As a value investor, the stock is a hold for me.

This article first appeared on GuruFocus.