Hershey's (HSY) Q2 Earnings Top Estimates, Sales Grow Y/Y

The Hershey Company HSY delivered impressive second-quarter 2023 results as both the top and bottom lines increased year over year, and the latter beat the Zacks Consensus Estimate. Management pulled up its adjusted earnings per share (EPS) guidance while retaining its net sales growth view.

Hershey continued to benefit from solid pricing. The company’s categories sustained their robust performance, with consumer demand remaining strong globally. Additional capacity and elevated brand investments place Hershey well for the second half of 2023. Management raised its dividend by 15%.

Quarter in Detail

Hershey posted adjusted earnings of $2.01. The metric surpassed the Zacks Consensus Estimate of $1.89 and increased 11.7% year over year.

Consolidated net sales of $2,490.3 million rose 5% from the year-ago quarter’s level. The Zacks Consensus Estimate stood at $2,498 million. Organic sales on a constant-currency (cc) basis increased 5% due to higher list prices. However, volumes dropped due to unfavorable comparisons with the year-ago period’s inventory replenishment and the timing of summer promotion shipments.

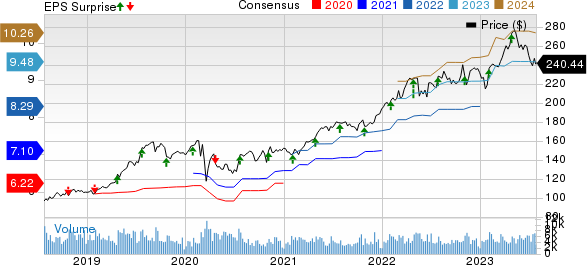

Hershey Company (The) Price, Consensus and EPS Surprise

Hershey Company (The) price-consensus-eps-surprise-chart | Hershey Company (The) Quote

The adjusted gross margin came in at 45.2%, up 130 basis points (bps) year over year. The upside can be attributed to increased price realization, an improved sales mix and productivity gains, partly countered by increased raw material costs, labor inflation and deleverage in volumes.

Selling, marketing and administrative expenses rose 5.2% year over year on increased levels of media and capability investments. Advertising and related consumer marketing expenses moved up 14.9%, with elevated investments across segments. Selling, marketing and administrative expenses, excluding advertising and related consumer marketing, increased 1.3% due to wage and benefits inflation, along with capability and technology investments.

The adjusted operating profit of $570.9 million rose 8.3%. The adjusted operating profit margin rose 70 bps to 22.9%. The upside can be attributed to favorable price realization and productivity gains, somewhat negated by supply-chain investments, and elevated brand and capability investments.

Segment Details

The North America Confectionery segment’s net sales increased 4.4% year over year to $1,993.1 million. Organic net sales at cc rose 4.8% due to net price realization, partly hurt by soft volumes.

The company’s U.S. candy, mint and gum (CMG) retail takeaway for the 12-week ended Jul 16, 2023 grew 9.6% (in multi-outlet plus convenience store channels or MULO+C). However, the CMG share decreased about 80 bps due to an adverse category mix and a rise in competitive innovation. The segment’s income advanced 6.2% to $657.1 million.

The North America Salty Snacks segment’s net sales jumped 6.3% from the year-ago quarter’s level to $272.4 million. The upside can be attributed to price realization, with volumes declining year over year. Hershey's U.S. salty snack retail takeaway for the 12-week period ended Jul 16, 2023 in MULO+C rose 9.6%. The segment’s income advanced 17.1% to $43.8 million.

Net sales in the International segment grew 8.5% to $224.8 million. At cc, organic net sales rose 6.2% due to a balanced increase in pricing and volumes. The segment’s profit came in at $41.1 million, up by $10.4 million from the year-ago period’s reported figure.

Other Financials & Guidance

HSY ended the quarter with cash and cash equivalents of $446.2 million, long-term debt of $4,086.2 million and total shareholders’ equity of $3,694.8 million. Management expects capital expenditures to the tune of $800-$850 million in 2023, aimed at core confection capacity expansion and constant investments in digital infrastructure.

2023 Guidance

Management continues to expect net sales growth of nearly 8% for 2023.

Adjusted EPS is now envisioned to increase 11-12% to the $9.46-$9.54 band in 2023. The metric was earlier expected to increase 11%.

Hershey now envisions a reported EPS increase of 13-15% to the $9.03-$9.15 range. Earlier, the company expected this metric to increase by 15%.

This Zacks Rank #4 (Sell) stock has tumbled 12% in the past three months compared with the industry’s decline of 10.9%.

Solid Staple Stocks

Some better-ranked consumer staple stocks are Energizer Holdings, Inc. ENR, TreeHouse Foods THS and Celsius Holdings CELH.

Energizer Holdings, which manufactures, markets and distributes household batteries, specialty batteries and lighting products, currently sports a Zacks Rank #1 (Strong Buy). ENR has a trailing four-quarter earnings surprise of 7.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Energizer Holdings’ current fiscal-year earnings suggests growth of about 2% from the year-ago reported numbers.

TreeHouse Foods, a food and beverage product company, currently sports a Zacks Rank #1. THS has a trailing four-quarter earnings surprise of 49.3%, on average.

The Zacks Consensus Estimate for TreeHouse Foods’ current fiscal-year earnings suggests growth of 120.1% from the year-ago reported figures.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2 (Buy). CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report