Hershey's (HSY) Q4 Earnings Coming Up: What Should You Know?

The Hershey Company HSY is likely to register top-line growth when it reports fourth-quarter 2023 earnings on Feb 8. The Zacks Consensus Estimate for revenues is pegged at $2.7 billion, suggesting an increase of 2.8% from the prior-year quarter’s reported figure.

The consensus mark for quarterly earnings has decreased around 1% in the past 30 days to $1.95 per share, which indicates a decline of 3.5% from the year-ago quarter’s reported figure. HSY has a trailing four-quarter earnings surprise of 9%, on average.

Factors to Consider

Hershey has been reaping the benefits of robust consumer demand globally. The company’s investment in brands, regular innovation and capabilities to drive growth have been fueling its performance. Also, contributions from prudent acquisitions have been adding to its sales.

Apart from this, effective pricing actions have been working well. Organic sales on a constant-currency (cc) basis increased 10.7% in the third quarter of 2023, fueled by price realization. In the North America Confectionery segment, price realization contributed 11 points of growth. Management expects pricing to have a high-single-digit benefit for the segment during the fourth quarter.

Our model suggests total company organic sales growth of 3.4% for the fourth quarter of 2023, with a 2.8% organic sales increase in the North America Confectionary segment.

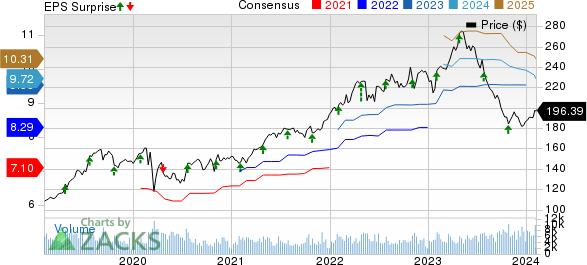

Hershey Company (The) Price, Consensus and EPS Surprise

Hershey Company (The) price-consensus-eps-surprise-chart | Hershey Company (The) Quote

However, Hershey has been grappling with higher selling, marketing and administrative expenses for a while. In the third quarter, the company’s selling, marketing and administrative expenses rose 13.1% year over year on increased levels of media and capability investments. Advertising and related consumer marketing expenses moved up 20%, with elevated investments across segments.

In the fourth quarter, management expects advertising spending to grow in the double digits as it continues to support the sell-through of seasonal items and starts to reactivate the Salty Snacks brands post-ERP transition. Further, the company expects non-advertising SG&A spending to rise in the low single digits, reflecting increases in technology and capability investments. These may have impacted the bottom line. We expect selling, marketing and administrative expenses to have increased 7% in the fourth quarter.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for The Hershey Company this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

The Hershey Company has an Earnings ESP of -0.73%, while it carries a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies worth considering as our model shows that these have the correct combination to beat on earnings this time:

Inter Parfums IPAR currently has an Earnings ESP of +11.27% and a Zacks Rank of 2. The company is likely to register a top-line increase when it reports fourth-quarter 2023 numbers. The Zacks Consensus Estimate for Inter Parfums’ quarterly revenues is pegged at $329.1 million, indicating a rise of 5.9% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ quarterly earnings of 35 cents suggests a decrease of 50.7% from the year-ago quarter’s levels. IPAR has a trailing four-quarter earnings surprise of 45.7%, on average.

Coca-Cola KO has an Earnings ESP of +0.70% and a Zacks Rank of 2. KO is likely to register top-and-bottom-line growth when it reports the fourth-quarter 2023 numbers. The Zacks Consensus Estimate for Coca-Cola’s quarterly revenues is pegged at $10.6 billion, suggesting growth of 5% from that reported in the prior-year quarter.

The Zacks Consensus Estimate for Coca-Cola’s quarterly earnings has been unchanged in the past 30 days at 48 cents per share. The consensus estimate for earnings suggests 6.7% growth from the year-ago quarter’s reported number. KO has delivered an earnings beat of 5.1%, on average, in the trailing four quarters.

TreeHouse Foods THS currently has an Earnings ESP of +7.04% and a Zacks Rank #2. THS is likely to record a top-and-bottom-line decline when it reports fourth-quarter 2023 results.

The Zacks Consensus Estimate for revenues is pegged at $926.9 million, indicating a 7% drop from the prior-year quarter’s actual. The consensus mark for earnings is pegged at 71 cents per share, implying a 27.6% decrease from that reported in the year-ago quarter. THS has a trailing four-quarter earnings surprise of 26.5%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Hershey Company (The) (HSY) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report