Hess Midstream LP (HESM) Reports Increased Throughput and Earnings Growth in Q4 2023

Net Income: $152.8 million, with $37.5 million attributable to Hess Midstream LP.

Adjusted EBITDA: $264.1 million, reflecting operational efficiency and volume growth.

Throughput Volumes: Significant increases across gas processing, oil terminaling, and water gathering.

Distributions: Quarterly cash distribution increased to $0.6343 per Class A share, up 2.7% from Q3 2023.

Capital Expenditures: $71.8 million invested primarily in gas compression capacity expansion.

Leverage: Debt at approximately $3.2 billion, representing a leverage ratio of 3.2x Adjusted EBITDA.

On January 31, 2024, Hess Midstream LP (NYSE:HESM) released its 8-K filing, detailing a strong finish to the year with increased throughput volumes and net income. The company, a key player in the midstream oil and gas sector, owns and operates a diverse set of assets, including natural gas gathering and compression, crude oil gathering, and produced water gathering and disposal. With a focus on the Bakken and Three Forks Shale plays, Hess Midstream LP provides essential services to both Hess Corporation and third-party customers.

Operational and Financial Highlights

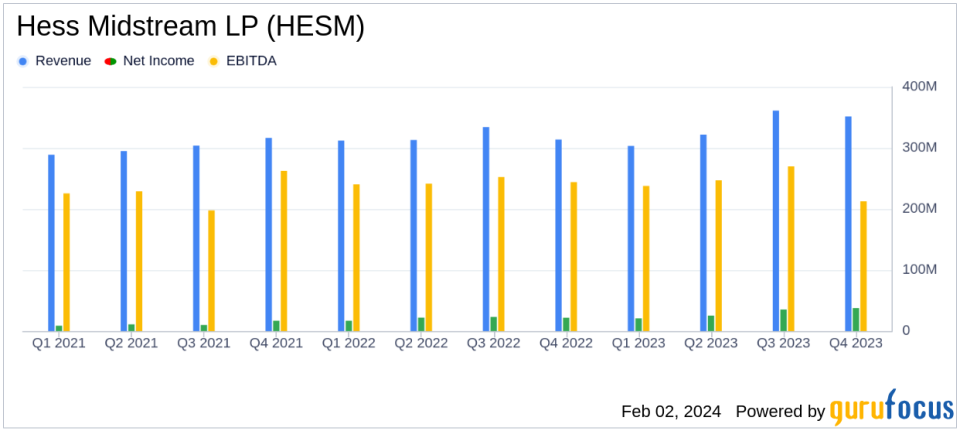

Hess Midstream LP reported a net income of $152.8 million for the fourth quarter of 2023, a slight increase from $149.8 million in the same quarter of the previous year. The net income attributable to Hess Midstream LP was $37.5 million, or $0.55 per Class A share, after accounting for noncontrolling interests. This represents an increase from $0.49 per Class A share in the fourth quarter of 2022. The company's Adjusted EBITDA stood at $264.1 million, while Adjusted Free Cash Flow reached $146.6 million.

President and COO John Gatling highlighted the year's strong performance and execution, with significant volume growth and expansion of the gas gathering system capacity. The company's focus on reliable operations and minimum volume commitments has positioned it well for sustained throughput growth.

"2023 was a year of continued strong performance and execution for Hess Midstream, as we achieved significant volume growth and further expanded our gas gathering system capacity supporting basin gas capture goals," said John Gatling, President and Chief Operating Officer of Hess Midstream. "We are focused on reliable operating performance and are positioned well to deliver visible and sustained throughput growth underpinned by our minimum volume commitments."

Financial Performance Analysis

Revenues for Q4 2023 were $356.5 million, an increase from $314.6 million in the prior-year quarter. The increase was primarily due to higher physical volumes and tariff rates. However, the company experienced a decrease in shortfall fees as actual physical volumes in 2023 were at or above minimum volume commitments. Operating costs and expenses rose to $146.4 million from $118.2 million, mainly due to higher maintenance expenses and costs related to additional assets placed in service.

Interest expenses also increased to $47.8 million, up from $40.7 million in the prior-year quarter, attributable to higher interest rates on credit facilities and increased borrowings. The company's leverage remained stable with a debt of approximately $3.2 billion, representing a leverage ratio of 3.2x Adjusted EBITDA.

Operational highlights include the completion of two new compressor stations, expected to provide approximately 100 MMcf/d of installed capacity, with the potential for further expansion. Throughput volumes saw a significant increase across the board, with gas processing up 24%, oil terminaling up 19%, and water gathering up 47% compared to the prior-year quarter.

Capital expenditures for the quarter totaled $71.8 million, primarily for the expansion of gas compression capacity. The Board of Directors declared a quarterly cash distribution of $0.6343 per Class A share, in line with the company's target of at least 5% growth in annual distributions per Class A share through 2025.

Hess Midstream LP's robust performance in the fourth quarter of 2023 underscores its strategic position within the midstream sector, with a focus on operational excellence and growth-oriented initiatives. The company's financial achievements and operational advancements demonstrate its commitment to delivering value to shareholders and maintaining a strong financial foundation.

For more detailed information on Hess Midstream LP's financial results, operational achievements, and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Hess Midstream LP for further details.

This article first appeared on GuruFocus.