Hewlett Packard (HPE) Q2 Preview: Rebound Quarter Inbound?

The Zacks Computer and Technology Sector has been hit hard in 2022, down more than 25% and vastly underperforming the S&P 500. Over the last month, however, the sector has tacked on a solid 4%, undoubtedly a positive.

A popular company in the sector, Hewlett Packard Enterprise Company HPE, is on deck to unveil Q3 results on Tuesday, August 30th, after market close.

Hewlett Packard Enterprise was formed as a result of the split of Hewlett-Packard Company into two separate entities – one focusing on the enterprise-facing hardware and service business and the other focusing on the consumer-facing computer and printer segments.

HPE now focuses on the enterprise and service business-oriented company. In addition, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

How does everything stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

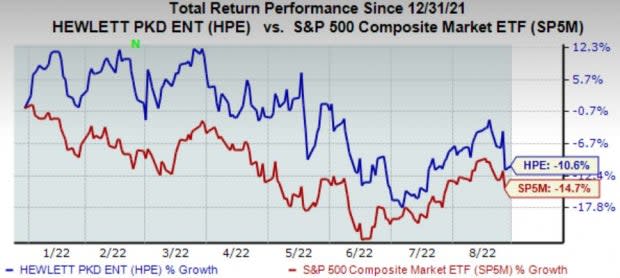

HPE shares have tumbled year-to-date, down more than 10%. Still, shares have outperformed the S&P 500, a worthy highlight.

Image Source: Zacks Investment Research

However, HPE shares have lagged the general market over the last month, declining roughly 4% vs. the S&P 500’s 1.5% decline.

Image Source: Zacks Investment Research

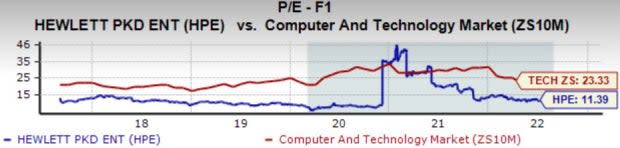

In addition, Hewlett Packard Enterprise shares trade at rock-solid valuation levels, further bolstered by its Style Score of an A for Value.

HPE’s forward earnings multiple resides at 11.4X, representing a steep 51% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has lowered their earnings outlook over the last 60 days. Still, the Zacks Consensus EPS Estimate of $0.48 reflects a respectable 2.1% Y/Y uptick in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line looks to add some marginal growth as well – the Zacks Consensus Sales Estimate of $7 billion pencils in a 1% uptick year-over-year.

Quarterly Performance & Market Reactions

HPE has primarily reported bottom-line results above estimates, exceeding the Zacks Consensus EPS Estimate in eight of its previous ten quarters. However, in its latest quarter, the company registered a 2.2% bottom-line miss.

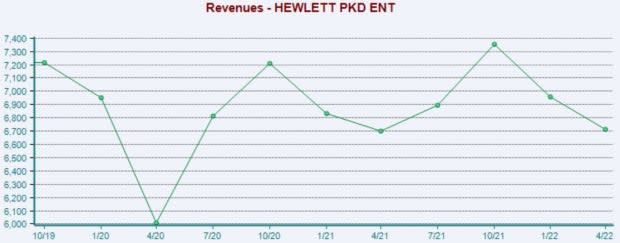

Top-line results have left much to be desired; Hewlett Packard Enterprise has missed on the top-line in each of its previous four quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market hasn’t reacted favorably in response to HPE’s quarterly reports as of late, with shares moving downwards following two of its previous three releases.

Bottom Line

HPE shares have lagged over the last month but have posted market-beating returns year-to-date.

The company’s valuation levels appear solid, with its forward earnings multiple nicely below its Zacks Sector average.

One analyst has lowered their quarterly earnings outlook, but estimates reflect solid growth within revenue and earnings.

HPE has consistently exceeded bottom-line estimates, but quarterly revenue has come in under expectations repeatedly as of late.

Heading into the print, Hewlett Packard Enterprise HPE carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 1.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research