Hewlett Packard (HPE) Q3 Earnings Beat, Revenues Rise Y/Y

Hewlett Packard Enterprise HPE reported third-quarter fiscal 2023 non-GAAP earnings of 49 cents per share, which came ahead of the Zacks Consensus Estimate by 6.52%. The reported figure was 12.1% higher than the year-ago quarter’s earnings of 48 cents per share.

Revenues of $7 billion increased 0.7% (up 3.5% at constant currency [cc]) from the prior-year quarter and beat the consensus mark by 0.35%. The annualized revenue run rate was up 48% year over year to $1.3 billion.

Hewlett Packard continued to witness the increased demand for its products and services during the quarter. Despite high inflationary pressure, macroeconomic headwinds and geopolitical issues, the company witnessed an increase in earnings and sales.

The top line benefited from exceptional performance in areas like the Intelligent Edge, where revenues have set its fifth consecutive quarterly record and HPE GreenLake, which continues to accelerate strategic pivot, generating higher recurring revenues and gross profit across four product segments, driven by the increased mix of high-margin software and services.

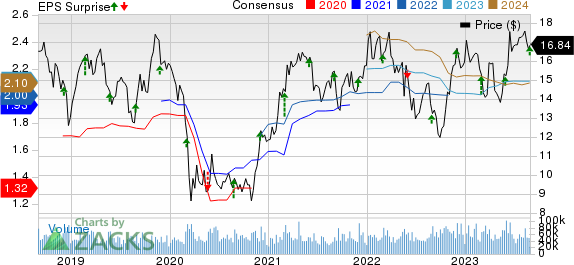

Hewlett Packard Enterprise Company Price, Consensus and EPS Surprise

Hewlett Packard Enterprise Company price-consensus-eps-surprise-chart | Hewlett Packard Enterprise Company Quote

Segment Performance

Segment-wise, High-Performance Compute & Artificial Intelligence revenues increased 1% (up 3% at cc) year over year to $836 million. The segment’s operating margin came in at (0.8)% compared with 3.4% reported in the year-ago quarter.

The Compute division’s sales declined 13% (down 10% at cc) year over year to $2.6 billion. The division witnessed 10.9% operating profit margin compared with 13.5% reported in the year-ago quarter.

Revenues in the Intelligent Edge division rose 50% (up 53% at cc) year over year to $1.4 billion during the quarter, primarily driven by strong customer demand. The division witnessed 29.7% operating profit margin expansion from 16.5% reported in the year-ago quarter.

Financial Service revenues increased 7% from the prior-year period and at cc to $873 million with 8.4% operating profit margin compared with 11.8% from the prior-year period. Net portfolio assets of $13.5 billion increased 7.5% year over year.

Revenues from the Storage business were down 5% (down 2% at cc) year over year to $1.1 billion. The division witnessed 10.7% operating profit margin from 14.3% reported in the year-ago quarter.

Corporate Investments & Other revenues were $318 million, up 6% year over year.

Operating Results

The non-GAAP gross profit decreased 0.4% to $2.51 billion. Meanwhile, the non-GAAP margin contracted 400 basis points (bps) to 35.9%.

Hewlett Packard’s non-GAAP operating profit decreased 1.5% to $718 million, while the non-GAAP operating margin contracted 200 bps year over year to 10.3%.

Balance Sheet and Cash Flow

Hewlett Packard ended the fiscal third quarter with $2.91 billion in cash and cash equivalents compared with $2.78 billion at the end of the previous quarter.

In the fiscal third quarter, HPE generated $1.5 billion in cash for operational activities and $955 million in free cash flow.

The company returned $341 million to shareholders through repurchasing $187 million worth of its common stock and $154 million in dividend payments in the reported quarter.

HPE announced that its board approved a quarterly cash dividend of 12 cents per share payable on Oct 13, 2023, to the shareholders recorded as of Sep 14, 2023.

Guidance

Hewlett Packard initiated guidance for the fiscal fourth quarter and raised the outlook for fiscal 2023. The company forecasts to generate revenues between $7.2 billion and $7.5 billion in the fiscal fourth quarter. The company estimates GAAP and non-GAAP diluted net earnings per share (EPS) in the range of 36-40 cents and 48-52 cents, respectively.

For fiscal 2023, HPE reiterates GAAP diluted net EPS in the range of $1.42-$1.46 and raises non-GAAP diluted net EPS guidance in the range of $2.11-$2.15 from the previous guidance of $2.06-$2.14.

Moreover, the company now estimates revenues to grow in the range of 4-6% adjusted for currency. HPE continues to anticipate free cash flow in the band of $1.9-$2.1 billion.

Zacks Rank & Other Stocks to Consider

Hewlett Packard currently has a Zacks Rank #2 (Buy). Shares of HPE have gained 5.5% in the year-to-date period.

Some other top-ranked stocks from the broader Computer and Technology sector are NVIDIA NVDA, Manhattan Associates MANH and CrowdStrike CRWD. NVIDIA and Manhattan Associates sport a Zacks Rank #1 (Strong Buy) each, while CrowdStrike carries a Zacks Rank #2 at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's third-quarter fiscal 2024 earnings has been revised upward by 39.7% to $3.24 per share in the past seven days. For fiscal 2024, earnings estimates have increased by 30.8% to $10.46 per share in the past seven days.

NVIDIA’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters, while missing on one occasion, the average surprise being 9.8%. Shares of NVDA have surged 233.8% in the year-to-date period.

The Zacks Consensus Estimate for Manhattan Associates’ third-quarter 2023 earnings per share has been revised 5 cents northward to 77 cents in the past 60 days. For 2023, earnings estimates have moved 22 cents upward to $3.09 per share in the past 60 days.

Manhattan Associates’ earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 31.6%. Year to date, shares of MANH have rallied 65.1%.

The Zacks Consensus Estimate for CrowdStrike's second-quarter fiscal 2024 earnings has remained unchanged at 56 cents per share in the past 60 days. For fiscal 2024, earnings estimates have remained unchanged at $2.39 per share in the past 60 days.

CrowdStrike's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19.2%. Shares of CRWD have risen 39.3% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report