HHLR ADVISORS, LTD. Increases Stake in Kiniksa Pharmaceuticals Ltd

Introduction to the Transaction

On December 31, 2022, HHLR ADVISORS, LTD. added 621,278 shares of Kiniksa Pharmaceuticals Ltd (NASDAQ:KNSA), increasing its stake by 21.28%. The shares were acquired at a trade price of $14.98 each, bringing the firm's total holdings in KNSA to 3,541,301 shares. This transaction had a 0.24% impact on the guru's portfolio, and the traded stock now represents 1.39% of the guru's portfolio. Furthermore, HHLR ADVISORS, LTD. now holds 9.90% of the total shares of Kiniksa Pharmaceuticals Ltd.

Profile of the Guru

HHLR ADVISORS, LTD., a firm based in Grand Cayman, operates from the Windward 3 Building, Regatta Office Park, West Bay Road. The firm currently holds 60 stocks in its portfolio, with a total equity of $4.7 billion. The top holdings of the firm include BeiGene Ltd(NASDAQ:BGNE), Alibaba Group Holding Ltd(NYSE:BABA), PDD Holdings Inc(NASDAQ:PDD), Legend Biotech Corp(NASDAQ:LEGN), and KE Holdings Inc(NYSE:BEKE). The firm's investment philosophy is primarily focused on the Healthcare and Consumer Cyclical sectors.

Overview of the Traded Stock

Kiniksa Pharmaceuticals Ltd (NASDAQ:KNSA), a clinical-stage biopharmaceutical company based in Bermuda, was listed on the stock exchange on May 24, 2018. The company is dedicated to discovering, acquiring, developing, and commercializing therapeutic medicines for patients suffering from debilitating diseases. As of August 19, 2023, the company has a market capitalization of $1.18 billion and a stock price of $16.82. The PE percentage of the stock is 5.14, indicating that the company is profitable.

Analysis of the Stock's Performance

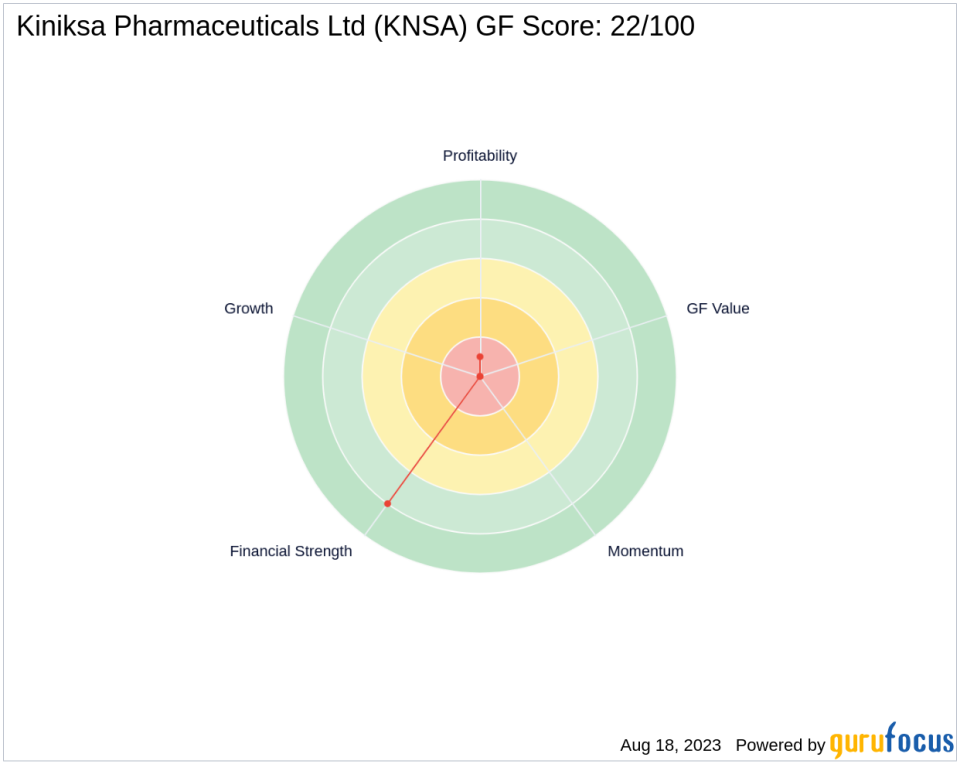

Since the transaction, the stock has gained 12.28%, but it has lost 31.21% since its IPO. The year-to-date price change ratio is 16.48%. The GF Score of the stock is 22/100, suggesting that it has poor future performance potential.

Evaluation of the Stock's Financial Health

The financial strength of the stock is ranked 8/10, while its profitability rank is 1/10. The stock's Piotroski F-Score is 6, and its Altman Z score is 9.44, indicating a low risk of bankruptcy. The cash to debt ratio of the stock is 13.68, ranking it 666th in the industry.

Analysis of the Stock's Growth

Due to insufficient data, the gross margin growth, operating margin growth, 3-year revenue growth, EBITDA growth, and earning growth over the past 3 years of the stock cannot be evaluated.

Evaluation of the Stock's Momentum

The stock's RSI 5-day, 9-day, and 14-day values are 14.85, 35.44, and 44.76 respectively. The momentum index for 6-1 month and 12-1 month are 7.39 and 27.38 respectively. The stock's RSI 14-day rank is 923, and its momentum index 6-1 month rank is 357.

Conclusion

In conclusion, HHLR ADVISORS, LTD.'s recent acquisition of Kiniksa Pharmaceuticals Ltd shares represents a significant addition to its portfolio. Despite the stock's poor future performance potential as indicated by its GF Score, the firm's increased stake could suggest a belief in the stock's long-term prospects. However, investors should conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.