Hibbett Inc (HIBB) Reports Mixed Fiscal 2024 Results Amid Retail Headwinds

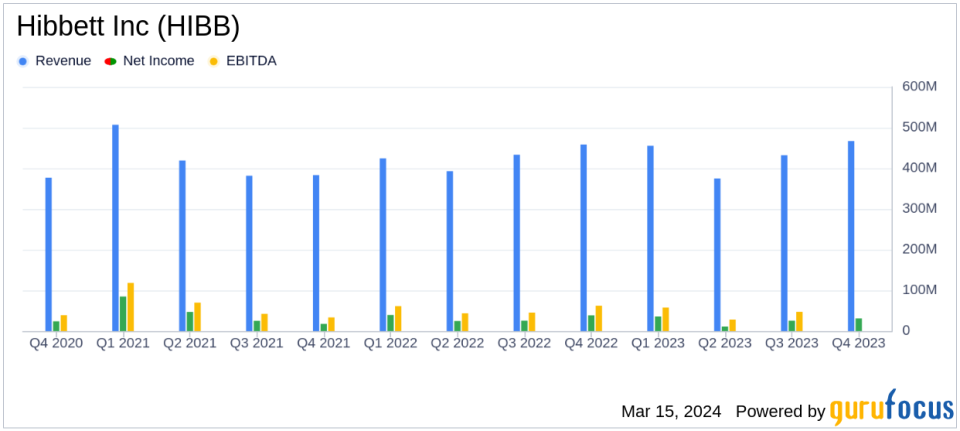

Net Sales: Fiscal 2024 net sales increased by 1.2% to $1.73 billion.

Comparable Sales: Q4 comparable sales decreased by 6.4%; full year comparable sales decreased by 3.1%.

Earnings Per Share (EPS): Q4 diluted EPS was $2.55; full year diluted EPS was $8.17.

Gross Margin: Gross margin for Q4 was 34.5%; full year gross margin was 33.8%.

Store Count: 14 new stores opened and 3 closed in Q4, bringing the total to 1,169.

Inventory: Inventory at the end of Q4 was down 18.2% from the previous year.

Fiscal 2025 Outlook: Sales expected to be flat to up ~2.0%; diluted EPS projected to be $8.00 to $8.75.

On March 15, 2024, Hibbett Inc (NASDAQ:HIBB) released its 8-K filing, detailing the financial results for the fourth quarter and full fiscal year 2024. The company, which operates athletic-inspired fashion retail stores, faced a challenging retail environment but managed to set a new full fiscal year sales record at $1.73 billion. Despite a decrease in comparable sales, Hibbett Inc (NASDAQ:HIBB) maintained a steady performance with a slight increase in net sales growth.

Financial Performance and Challenges

Hibbett Inc (NASDAQ:HIBB) reported a 1.8% increase in net sales for the 14-week period ending February 3, 2024, compared to the same period last year. However, comparable sales saw a 6.4% decline, with brick and mortar sales dropping by 9.2%. E-commerce sales provided a silver lining with a 6.9% increase. The company's gross margin faced a slight contraction, primarily due to lower average product margins and increased store occupancy costs.

Net income for the quarter was $30.9 million, translating to a diluted EPS of $2.55, down from $38.4 million and $2.91 per diluted share in the previous year. The company's balance sheet reflects a healthy cash position and a significant reduction in inventory levels, which may indicate efficient inventory management in response to the challenging retail landscape.

Strategic Highlights and Financial Achievements

President and CEO Mike Longo highlighted the company's strategic initiatives, including the integration of Hibbett Rewards X Nike Membership, which aims to drive sales growth across all retail channels. The company's focus on customer service and omni-channel capabilities were also emphasized as key drivers for future growth.

"We are pleased to report a solid financial performance for the fourth quarter of Fiscal 2024, as we continued to execute our strategy in a dynamic and challenging retail environment," said Mike Longo, President and CEO of Hibbett.

Despite the headwinds, Hibbett Inc (NASDAQ:HIBB) managed to open new stores and close fewer, ending the fiscal year with a net increase in store count. This expansion reflects the company's confidence in its business model and long-term growth prospects.

Looking Ahead: Fiscal 2025 Outlook

For Fiscal 2025, Hibbett Inc (NASDAQ:HIBB) anticipates flat to approximately 2.0% growth in total net sales and a diluted EPS range of $8.00 to $8.75. The company plans to continue investing in store development initiatives, with capital expenditures expected to be between $65 to $75 million. These investments, along with the company's capital allocation strategy, which includes share repurchases and quarterly dividends, are aimed at delivering greater value to customers and shareholders alike.

Value investors may find Hibbett Inc (NASDAQ:HIBB)'s steady performance, strategic investments, and commitment to shareholder returns appealing, despite the broader challenges in the retail sector. The company's ability to navigate a complex retail environment while maintaining financial discipline positions it as a potentially resilient player in the athletic-inspired fashion retail space.

For a more detailed analysis of Hibbett Inc (NASDAQ:HIBB)'s financial results and future outlook, investors are encouraged to review the full 8-K filing and consider joining the upcoming investor conference call.

Explore the complete 8-K earnings release (here) from Hibbett Inc for further details.

This article first appeared on GuruFocus.