Is Hibbett Inc. (HIBB) Significantly Undervalued?

On August 25, 2023, Hibbett Inc (NASDAQ:HIBB) saw a daily gain of 23.71%, contrasting with a 3-month loss of 18.12%. With an Earnings Per Share (EPS) (EPS) of 9.45, the question arises: is Hibbett significantly undervalued? This article aims to provide a comprehensive valuation analysis of Hibbett (NASDAQ:HIBB). We invite you to delve into this analysis to gain insights into Hibbett's intrinsic value.

About Hibbett Inc.

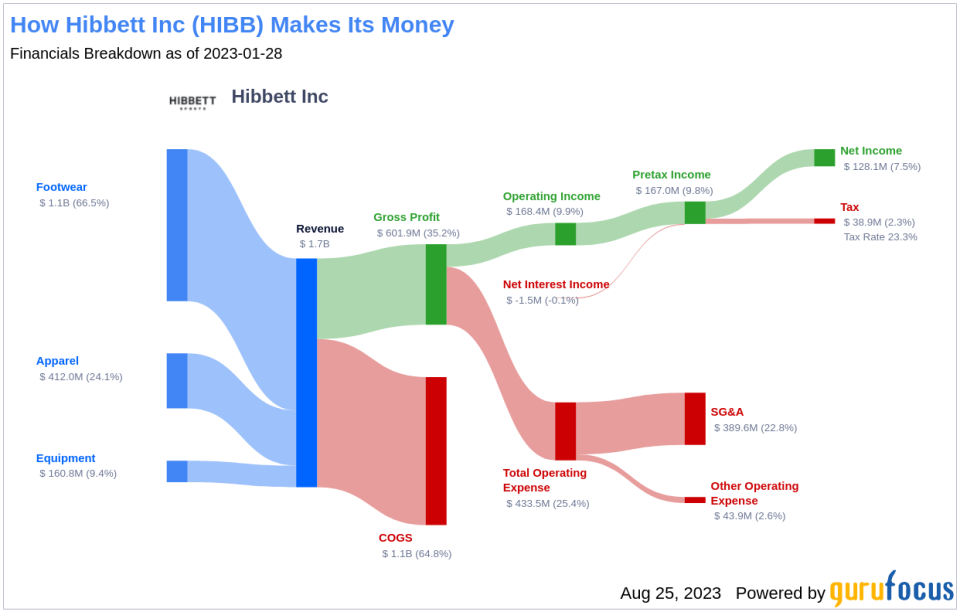

Hibbett Inc is a sports goods retailer, operating small to midsize stores primarily in the South, Southwest, mid-Atlantic, and Midwest regions of the United States. The company offers a broad range of sporting goods, including apparel, footwear, accessories, and equipment needed for team sports. Hibbett stocks brands such as Nike, Under Armour, Adidas, The North Face, Jordan, Costa, and others. The company operates three kinds of stores: Hibbett Sports, City Gear, and Sports Additions.

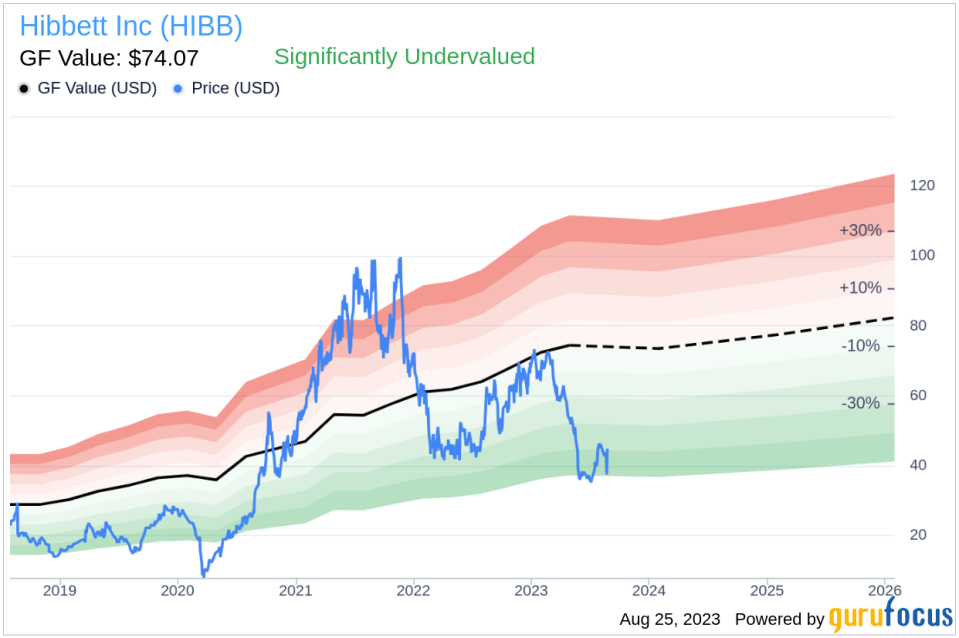

Understanding the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on the company's past performance and growth, and future business performance estimates. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

As per the GF Value, Hibbett (NASDAQ:HIBB) appears to be significantly undervalued. At its current price of $45.6 per share, Hibbett's stock is likely to offer much higher long-term returns than its business growth, given its significant undervaluation.

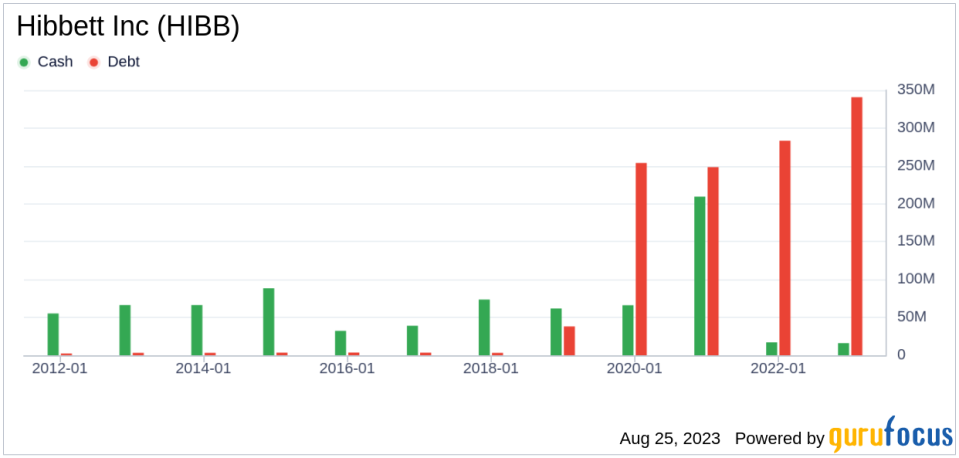

Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Hence, it's crucial to review a company's financial strength before deciding to buy its stock. Hibbett's cash-to-debt ratio of 0.07 is lower than 86.26% of 1092 companies in the Retail - Cyclical industry. However, GuruFocus ranks Hibbett's overall financial strength at 7 out of 10, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies typically carries less risk, especially if the company has demonstrated consistent profitability over the long term. Hibbett has been profitable for ten years over the past decade. In the last 12 months, the company had revenues of $1.70 billion and an EPS of $9.45. Its operating margin of 9.4% is better than 76.44% of 1095 companies in the Retail - Cyclical industry. Overall, GuruFocus ranks Hibbett's profitability as strong.

Growth is a crucial factor in a company's valuation. Hibbett's 3-year average revenue growth rate is better than 86.23% of 1046 companies in the Retail - Cyclical industry. Its 3-year average EBITDA growth rate is 62.6%, ranking better than 93.23% of 901 companies in the same industry.

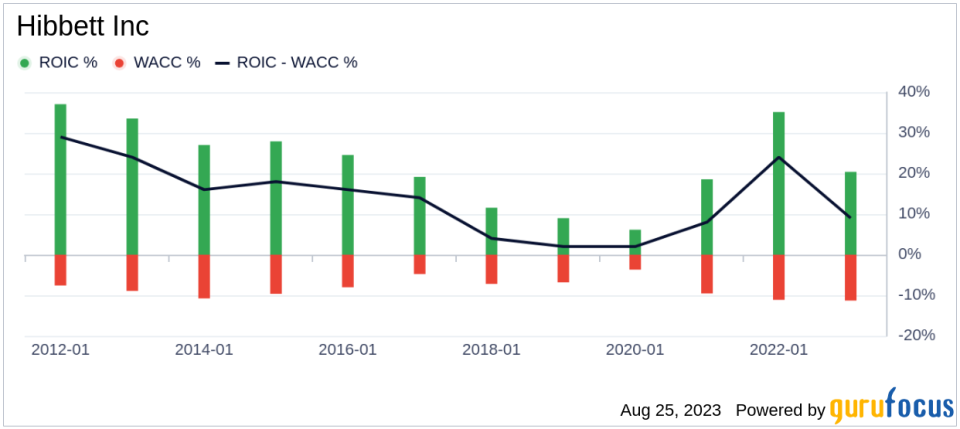

ROIC vs WACC

A company's profitability can also be evaluated by comparing its return on invested capital (ROIC) to its weighted average cost of capital (WACC). Hibbett's ROIC of 18.36 is higher than its WACC of 7.11, suggesting that the company is likely creating value for its shareholders.

Conclusion

In conclusion, Hibbett (NASDAQ:HIBB) appears to be significantly undervalued. The company's financial condition is fair, and its profitability is strong. Its growth ranks better than 93.23% of 901 companies in the Retail - Cyclical industry. For more details about Hibbett stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.